Stock

Many are watching the disaster in growth stocks unfold, including us at EarningsBeats.com, but the reality is that many other areas of the stock...

Hi, what are you looking for?

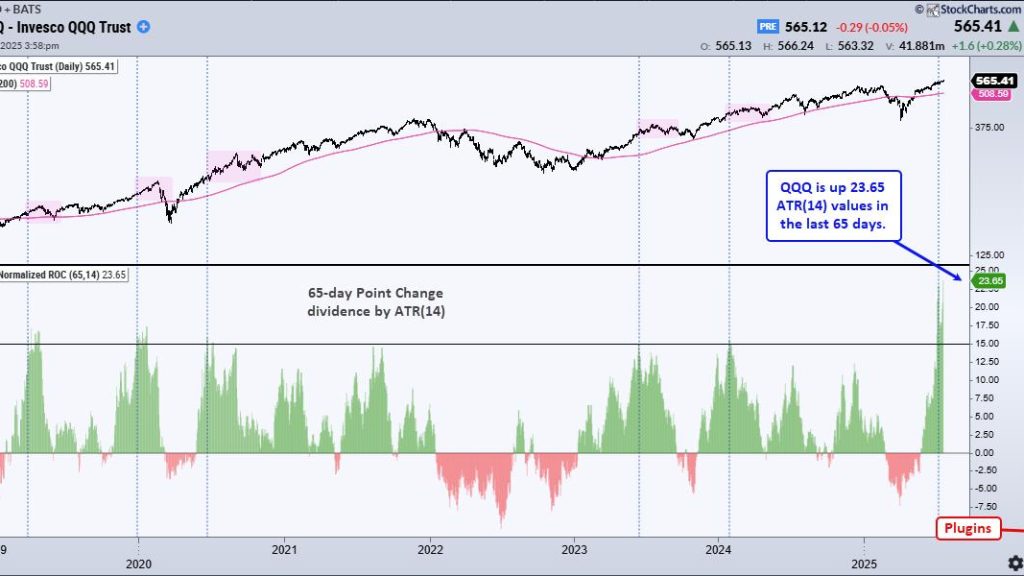

Here are some charts that reflect our areas of focus this week at TrendInvestorPro. SPY and QQQ are leading the market, but the tech...

The S&P 500 ($SPX) just logged its fifth straight trading box breakout, which means that, of the five trading ranges the index has experienced...

Is the market’s next surge already underway? Find out with Tom Bowley’s breakdown of where the money is flowing now and how you can...

Many are watching the disaster in growth stocks unfold, including us at EarningsBeats.com, but the reality is that many other areas of the stock...

Growth stocks just took a sharp hit—what does it mean for the market? In this video, Mary Ellen breaks down the impact, reveals why...

In my recent podcast interview with Jay Woods of Freedom Capital Markets, we discussed and debated the evolving landscape for equities and other risk...

As part of our regular market review in the DP Alert, we have begun to notice a very good indicator to determine market weakness...

In this exclusive StockCharts video, Julius analyzes seasonality for U.S. sectors and aligns it with current sector rotation. He explores how these trends impact...

The Russell 2000 ETF triggered a bearish trend signal this week and continues to underperform S&P 500 SPDR, which remains with a bullish trend...

As “economic softening” increasingly emerges as the prevailing narrative driving the markets, the retail sector occupies a peculiar space amid these shifts in investor...

Bristol Myers Squibb (BMY) reported strong Q4 earnings earlier in February, and prospects remain strong for 2025, although it may face some headwinds. The...

In this exclusive StockCharts video, Joe breaks down reverse divergences (hidden divergence), key upside & downside signals, and how to use ADX and Moving...

Sector rotation is difficult to spot in real time because it unfolds over weeks or months and isn’t always obvious until after the fact....