Stock

It was an ugly close to another roller-coaster trading week as the stock market struggled with several moving parts. Wednesday’s Evening Doji Star in...

Hi, what are you looking for?

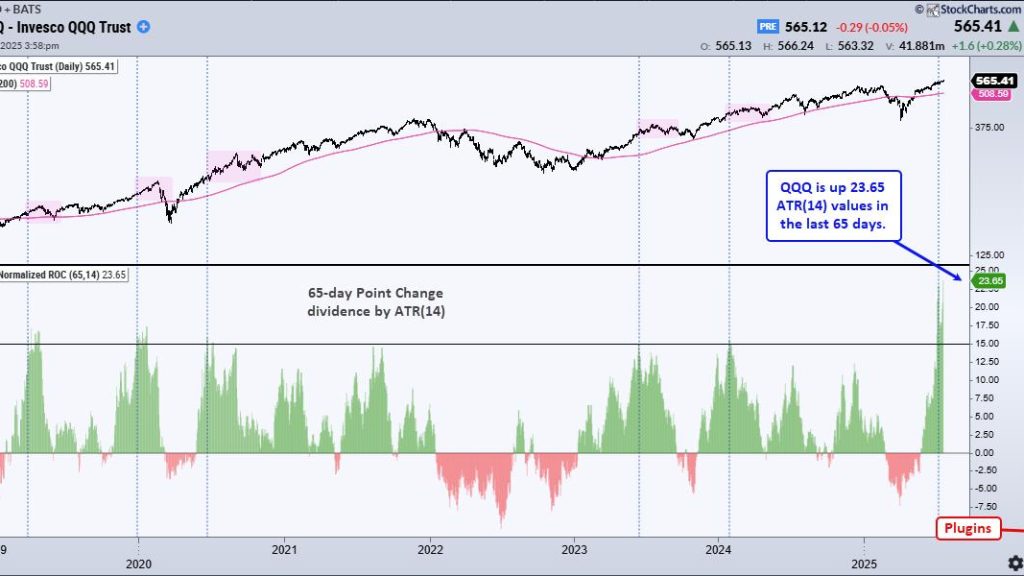

Here are some charts that reflect our areas of focus this week at TrendInvestorPro. SPY and QQQ are leading the market, but the tech...

The S&P 500 ($SPX) just logged its fifth straight trading box breakout, which means that, of the five trading ranges the index has experienced...

Is the market’s next surge already underway? Find out with Tom Bowley’s breakdown of where the money is flowing now and how you can...

It was an ugly close to another roller-coaster trading week as the stock market struggled with several moving parts. Wednesday’s Evening Doji Star in...

Is a new market uptrend on the horizon? In this video, Mary Ellen breaks down the latest stock market outlook, revealing key signals that...

The key resistance level I’ve been watching on the S&P 500 hasn’t wavered. It’s 5782. The bulls had a real chance this past week...

Sector rotation is shaping the S&P 500’s next big move! In this exclusive StockCharts video, Julius analyzes SPY support levels, key sector trends, and...

This week, we get back to earnings and, sadly, the pickings are slim.Given these turbulent times, we have two Consumer Staples stocks to examine...

One of the indicators that Carl Swenlin developed is the Silver Cross Index. It is one of the best participation indicators out there! Here’s...

Friday’s overheated inflation data appears to have initiated a new downward leg for the major equity averages. This could mean a confirmed bear flag...

The performance profile for 2025 says a lot about the state of the market. Commodity-related ETFs are leading, non-cyclical equity ETFs are holding up...

Wednesday’s stock market price action revealed a caution sign, and with it, any hope that rose from Monday’s price action just got buried. The...

After a blistering snapback rally over last the week, a number of the Magnificent 7 stocks are actively testing their 200-day moving averages. Let’s...