Stock

S&P 500 earnings are in for 2024 Q4, and here is our valuation analysis.The following chart shows the normal value range of the S&P...

Hi, what are you looking for?

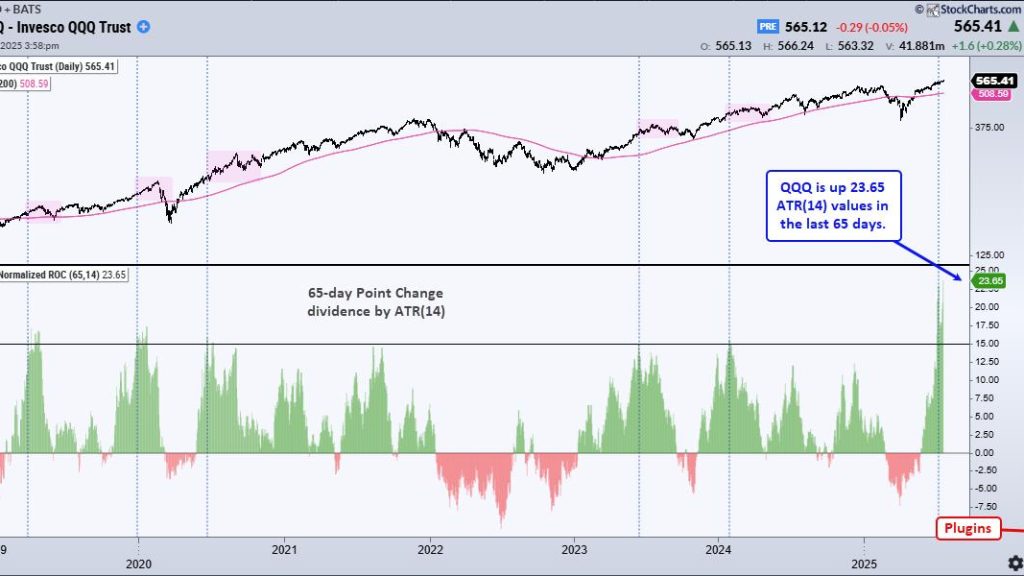

Here are some charts that reflect our areas of focus this week at TrendInvestorPro. SPY and QQQ are leading the market, but the tech...

The S&P 500 ($SPX) just logged its fifth straight trading box breakout, which means that, of the five trading ranges the index has experienced...

Is the market’s next surge already underway? Find out with Tom Bowley’s breakdown of where the money is flowing now and how you can...

S&P 500 earnings are in for 2024 Q4, and here is our valuation analysis.The following chart shows the normal value range of the S&P...

Is the stock market volatility making you nervous? In this video, Grayson Roze and Julius de Kempenaer unpack the volatile market environment and discuss...

Tariff turmoil continues sending the stock market into a turbulent spin. Tariffs went into effect at midnight, which sent equities and bond prices lower....

Is the stock market on the verge of crashing or has it bottomed? In this video, Joe Rabil uses moving averages and Fibonacci retracement...

The market is in a tailspin as tariffs add volatility to the market. Carl and Erin believe the SPY is in a bear market...

I am attending and speaking at the CMTA West Coast Regional Summit in San Francisco from Friday, 4/4, to Sunday, 4/6, so I don’t...

The previous week was short; the Indian markets traded for four days owing to one trading holiday on account of Ramadan Id. However, while...

How low can the S&P and the Nasdaq fall? More importantly, how can an investor navigate this volatile environment?In this eye-opening video, Mary Ellen...

The stock market hoped for curtailment of tariffs on Wednesday, but that didn’t happen. Even the better-than-expected March non-farm payrolls weren’t enough to turn...

American Water Works (AWK)Why focus on a utility that isn’t reporting earnings this week? It’s because the biggest question of the week is where...