Stock

There are a few very different setups unfolding this week, which are worth a closer look. Two software-related names that are struggling to reclaim...

Hi, what are you looking for?

Here are some charts that reflect our areas of focus this week at TrendInvestorPro. SPY and QQQ are leading the market, but the tech...

The S&P 500 ($SPX) just logged its fifth straight trading box breakout, which means that, of the five trading ranges the index has experienced...

Is the market’s next surge already underway? Find out with Tom Bowley’s breakdown of where the money is flowing now and how you can...

There are a few very different setups unfolding this week, which are worth a closer look. Two software-related names that are struggling to reclaim...

Sector Rotation: A Week of Stability Amidst Market DynamicsLast week presented an intriguing scenario in our sector rotation portfolio. For the first time in...

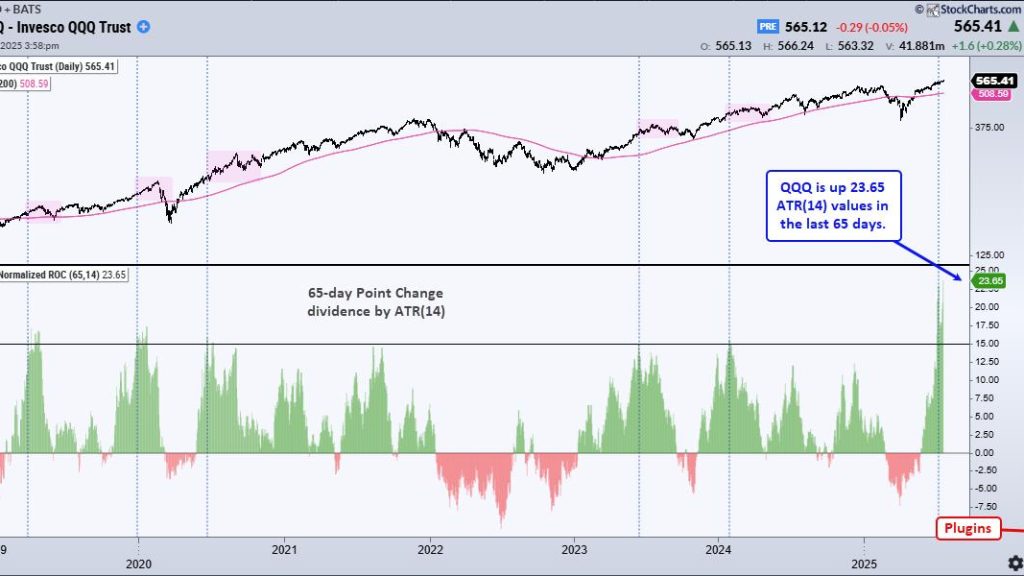

QQQ and tech ETFs are leading the surge off the April low, but there is another group leading year-to-date. Year-to-date performance is important because...

After consolidating for two weeks, the Nifty finally appeared to be flexing its muscles for a potential move higher. Over the past five sessions,...

Stay ahead of the market in under 30 minutes! In this video, Mary Ellen breaks down why the S&P 500 just broke out, which...

This week, we got a smorgasbord of jobs data — JOLTS, ADP, weekly jobless claims, and the nonfarm payrolls (NFP). Friday’s NFP, the big...

All of our major indices continue to rally off the April 7th, cyclical bear market low. A couple, however, have broken out of key...

Silver just hit a 13-year high, breaking above a key resistance level that could ignite a major bull run. Some metals analysts now say...

Most religions of the world have the fundamental beliefs that are strikingly similar to the Ten Commandments. History has taught humanity that life does...

I’m a huge fan of using platforms like StockCharts to help make my investment process more efficient and more effective. The StockCharts scan engine...