What is the Nasdaq 100 Future?

Traded on the Globex electronic trading platform of the Chicago Mercantile Exchange, Nasdaq 100 Futures is a stock index futures contract. The Nasdaq 100 stock market index is the basis for Nasdaq 100 Futures.

The Nasdaq 100 includes the shares of the top 100 non-financial American and foreign corporations, ranked by market capitalisation. E-mini Nasdaq futures, which are based on this index, are traded almost continuously on the Globex trading platform, starting at 4:30 PM and ending at 4:15 PM US EST the following day.

Nasdaq 100 Futures Today

The Nasdaq 100 futures are priced at 19,425, marking a 1.21% increase from the previous day. As of the last update, the Nasdaq 100 futures contract for September 2024 is trading at 19,635.50, reflecting a net change of -238 points or -1.21% from the previous close of 19,653.75. Over the past 52 weeks, the index has returned 25.95%, with a daily range from 19,227.25 to 19,691 and a 52-week range from 14,194 to 20,899.75.

The futures contract shows a year-to-date return of 18.30%, a 6-month return of 8.50%, a 3-month return of 4.50%, and a 1-month return of 2.70%.

Nasdaq Top Gainers Today

As of the latest update, here are some of the key figures for the top gainers in the Nasdaq 100 futures:

- Gilead Sciences (GILD): Trading at $78.93, up 0.47%.

- Vertex Pharmaceuticals (VRTX): Also showing positive movement, trading at $353.85, up 1.02%.

- Amgen (AMGN): Trading at $331.74, up 0.68%.

- Old Dominion Freight Line (ODFL): Trading at $194.90, up 0.36%.

- Illumina (ILMN): Trading at $133.46, up 1.33%.

- Biogen (BIIB): Trading at $204.93, up 0.36%.

- Booking Holdings (BKNG): Trading at $3,911.56, up 0.34%.

These figures reflect positive movements for these companies within the Nasdaq 100, contributing to their status as top gainers in today’s market.

Top Losers Today

Among the losers in the Nasdaq 100 today:

- Micron Technology (MU): Fell by $2.36 to $94.86. Match Group, Inc. (MTCH): Declined by $0.74 to $36.74. Lululemon Athletica (LULU): Decreased by $2.33 to $258.83.

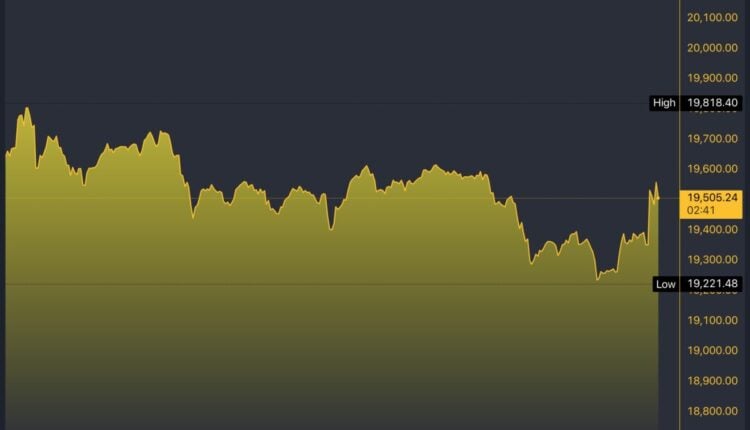

NDX/USD 5-Day Chart

Nasdaq News Today

The Nasdaq 100 dropped from its one-month high of $19,938 last week and is still trading near the 55-day moving average, currently at $19,550. To reach the June high of 20,006, this must be improved.

NVIDIA’s impressive 166% year-to-date stock price increase has contributed more than a third of the NASDAQ 100’s gain this year. The company’s earnings release on Wednesday after hours is expected to impact the near-term trend of the indices significantly.

A decline through Tuesday’s low of $19,374 might lead to a more substantial correction in the direction of the high of $18,949 on May 23. S&P 500 futures dropped 0.5% and Nasdaq 100 futures dropped 0.9%. Futures for the Dow Jones Industrial Average saw minimal movement in the interim.

After announcing that its third-quarter revenue would be roughly $32.5 billion, Nvidia’s stock fell 7%. Estimates varied as strong as $37.9 billion, although analysts had averaged $31.9 billion. Additionally, the business hinted that it was resolving production issues with its eagerly awaited new Blackwell chip.

The AI chipmaker beat top and bottom line estimates in its fiscal 2nd quarter and provided a positive sales outlook for the current quarter. Still, it fell short of traders’ expectations, who were hoping for a stronger beat.

Tech Stocks Wobble Amid Market Volatility

Nvidia’s revenue for the second quarter of its fiscal year, which ended on July 28, surged to over $30 billion. Additionally, the Santa Clara, California-based company board authorised an extra $50 billion in stock buybacks.

A renewed bout of volatility impacted the stock market following these results. At one point, the S&P 500 was on track for its biggest decline since the drop on August 5.

The index ultimately closed down 0.6%, avoiding a steeper decline, while the Nasdaq 100 fell by 1.2%. The VIX, a popular measure of Wall Street volatility, rose to around 17.

Ten-year Treasury yields increased by two basis points to 3.84%, and Bitcoin dropped below $60,000.

Following the sharp rise in global tech stocks over the last three weeks, future gains are expected to be more gradual, with rising volatility likely driven by potential downturns in US macroeconomic indicators and further news on semiconductor export controls, according to Solita Marcelli of UBS Global Wealth Management.

Nasdaq 100 Future: Has the Decline Already Begun?

The prior update, given two weeks ago, gives a decent overview of the most recent dependable work and calls. We have been waiting for a (retracement) swing back to $19,300–19,800, ideally since August 1.

As of right now, four days after the upgrade was published on August 22, the Nasdaq 100 future index reached its peak at $19,938. It is back to $19,400 now. The analysts raised the Bulls’ coloured warning levels to highlight thresholds where further uptrend would become less likely as the index increased in the days following the last update.

The index currently holds the grey 2nd warning level after falling below the blue first warning level. A daily close below $19,450, the second-to-last nail in the Bulls’ coffin, will indicate that the next leg lower has begun.

The previous update indicates that we can add up five larger signals from the vital low of October 2022 into the high of July.

Other Stock Markets News

Salesforce saw a rise that countered that decline. Following the business software giant’s beating of fiscal 2nd quarter forecasts and an increase in its full-year profit outlook, shares saw a 5% increase in trading.

Wall Street is recovering from a losing session after a decline in Nvidia stocks ahead of the company’s earnings announcement, which impacted major indices. The S&P 500 dropped 0.6%, the tech-heavy Nasdaq fell 1.12%, and the Dow Jones Industrial Average lost about 159 points, or 0.39%.

These actions highlight Nvidia’s growing significance in the broader market. The semiconductor giant now accounts for approximately 7% of the S&P 500 and, earlier this year, briefly became the world’s most valuable public company after surpassing the $3 trillion market capitalisation mark.

Final Thoughts

As we navigate the volatility in Nasdaq 100 futures, it is important to understand the effect of major factors such as Nvidia’s earnings and broader market conditions.

Nvidia’s earnings report has caused uncertainty in the market, proving its role in the tech sector and its impact on broader indices. Shifts in interest rates and the economic outlook could increase the potential for further declines in future Nasdaq 100 movements.

According to Bank of America, these developments show that short-term fluctuations are likely as investors adjust to evolving economic signals. These trends will be monitored to anticipate future market movements and make informed investment decisions.

The post Nasdaq 100 Future: Market Trends & Nvidia’s Impact appeared first on FinanceBrokerage.