SOUN Stock is Rallying. Should You Buy?

SoundHound AI (NASDAQ: SOUN) stock is in the spotlight, attracting both analysts’ and investors’ attention. Wall Street experts speculate about its prospects, claiming that this company has the potential to achieve great success in the coming months.

HC Wainwright gave the stock a “Buy” rating, setting its price target at $7.00. Such a figure suggests that the shares might surge forward by 40.28% in the short term.

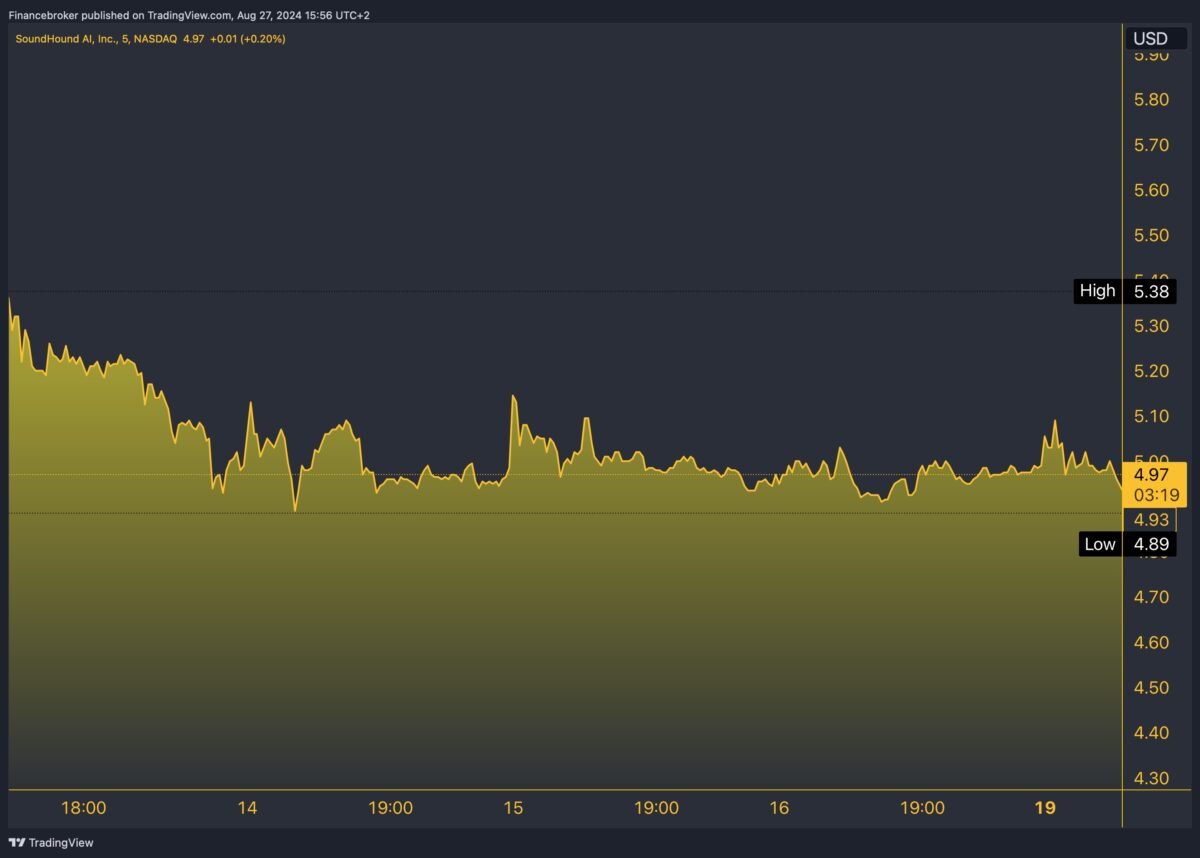

Currently, SOUN stock price stands at $4.97 per share. It rallied by 1.64% in the last five days. Moreover, the company’s market cap is $1.78B, which is really impressive. Its 52-week high stands at $10.25 thus far, while its 52-week low remains at $1.49.

SOUN stock news is promising, with the firm reporting strong earnings in the last quarter. Consequently, other analysts have also updated their ratings for its shares. For example, Northland Securities increased their price target on SoundHound AI (SOUN) to $6.00 from $5.50.

Meanwhile, Cantor Fitzgerald moved its rating for this stock from a “neutral” to an “overweight.” The latter means the shares will outperform their rivals in the sector. Cantor Fitzgerald has also raised its target price for SOUN from $5.00 to $7.00.

Moreover, Wedbush is another one giving the company an “outperform” rating, setting a $9.00 price target for its shares. Overall, the consensus for the SoundHound AI stock is a “Moderate Buy,” with a target price of $7.08.

SoundHound AI Stock Price And Performance

On Monday, the SOUN shares opened at $4.99. The company has a current ratio of 8.84, as well as a debt-to-equity ratio of 0.56, and a quick ratio of 8.84. A fifty-day simple moving average stands at $4.63, while a two-hundred-day simple moving average hit $4.73 at last.

On August 8, 2024, the company announced that SOUN stock earnings reached $0.11 per share (EPS) last quarter. They missed the analysts’ consensus estimate of $0.09 by $0.02. The stock has also had a negative net margin of 183.49% and a negative return on equity of 163.00%.

On the positive side, SoundHound AI reported $13.46 million in revenue during the quarter, compared to the expert’s forecast of $13.09 million. The firm’s revenue increased by 53.8% compared to the same quarter in 2023. Analysts think it will report -0.3 earnings per share for the current fiscal year.

SOUN/USD – 5 day-chart

Insider Exchanges at SoundHound AI

Insider buying and selling can affect the company’s development. If enough shares change hands, the new owners might gain the right to make major changes. That’s why investors follow such news; it might prove useful for determining the firm’s course.

SoundHound AI has recently experienced insider trading, with CTO Timothy Stonehocker selling 104,000 shares on June 5, 2025. The average stock price for SOUN was $5.00, and the total earnings from the sale amounted to $520,000.00.

Consequently, the chief technology officer controls 883,570 shares in the firm now, with a valuation of $4,417,850.

That’s not all, though. CEO Keyvan Mohajer also sold 116,504 shares of the stock SOUN on June 24. The average price per share was $3.95, and the total value reached $460,190.80. The chief executive officer purchased these and now owns 953,333 shares in SoundHound AI, valued at $3,765,665.35.

Insiders currently own 21.30% of the firm’s stock. In the last three months, they have sold 625,728 shares, worth $3,011,476 in total.

Such active exchanges indicate that the power is shifting inside the company. However, that’s not necessarily a bad thing. Moreover, such active buying from the team members shows that they have faith in this stock and expect it to flourish in the near future.

Still, the recent selloff on the global markets made investors more cautious. The tech stock prices will likely remain moderate in the coming weeks.

SOUN Stock Forecast: What Do the Analysts Say?

Last month, Roger McNamee of Elevation Partners discussed a report from Goldman Sachs. The latter stated that AI investments’ returns might fail to meet investors’ expectations in the following quarter.

McNamee noted that the tech sector now amassed so much capital investment that it will be hard-pressed to get enough returns to justify the investment amount.

Meanwhile, Aisa Ogoshi from JPMorgan Asset Management said that the AI-centric rally will likely start diversifying other sectors soon, and tech stocks must adjust to the new conditions.

She advised traders to follow the earnings trends, adding that investors tend to panic easily these days, but they need to calmly assess the situation and avoid rush decisions.

Despite warnings about lowered tech stock returns, SoundHound AI’s future seems bright. You might ask: “Is SOUN a good stock to buy?” The short answer is yes, but you should still research deeply to ensure this stock fits your portfolio and future goals.

Thus far, SOUN stock price prediction remains optimistic; analysts set its price target at $7.79 with a minimum estimate of $6.00 and a max estimate of $9.50. The company has recently announced that it plans to purchase AI startup Amelia AI for $80 million.

Amelia produces an AI agent that people can customise according to their needs. SoundHound AI stated that its revenue might skyrocket to over $150M in 2025. The team expects Amelia to contribute $45M in artificial intelligence software revenue.

Besides, SoundHound AI has strong long-term growth potential as companies are integrating voice AI solutions worldwide to reduce costs and improve efficiency. Thus, the stock can easily continue growing if the firm maintains its progress. So, is the SOUN stock buy or sell? The answer is a firm buy.

Still, remember that the stock market can be volatile, and you should research any stock thoroughly before investing in it. Stay tuned for more news about the financial world.

The post SOUN Stock is Soaring By 1.64%. Will It Maintain Its Gains? appeared first on FinanceBrokerage.