Good morning and welcome to this week’s Flight Path. Equities could not hold onto “Go” colors any longer and we saw a strong purple “NoGo” bar as the trend changed on the last bar of the week. GoNoGo Trend painted strong blue “Go” bars for treasury bond prices while the trend remained a “NoGo” for U.S. commodities and the dollar, both painting strong purple bars as the week came to a close.

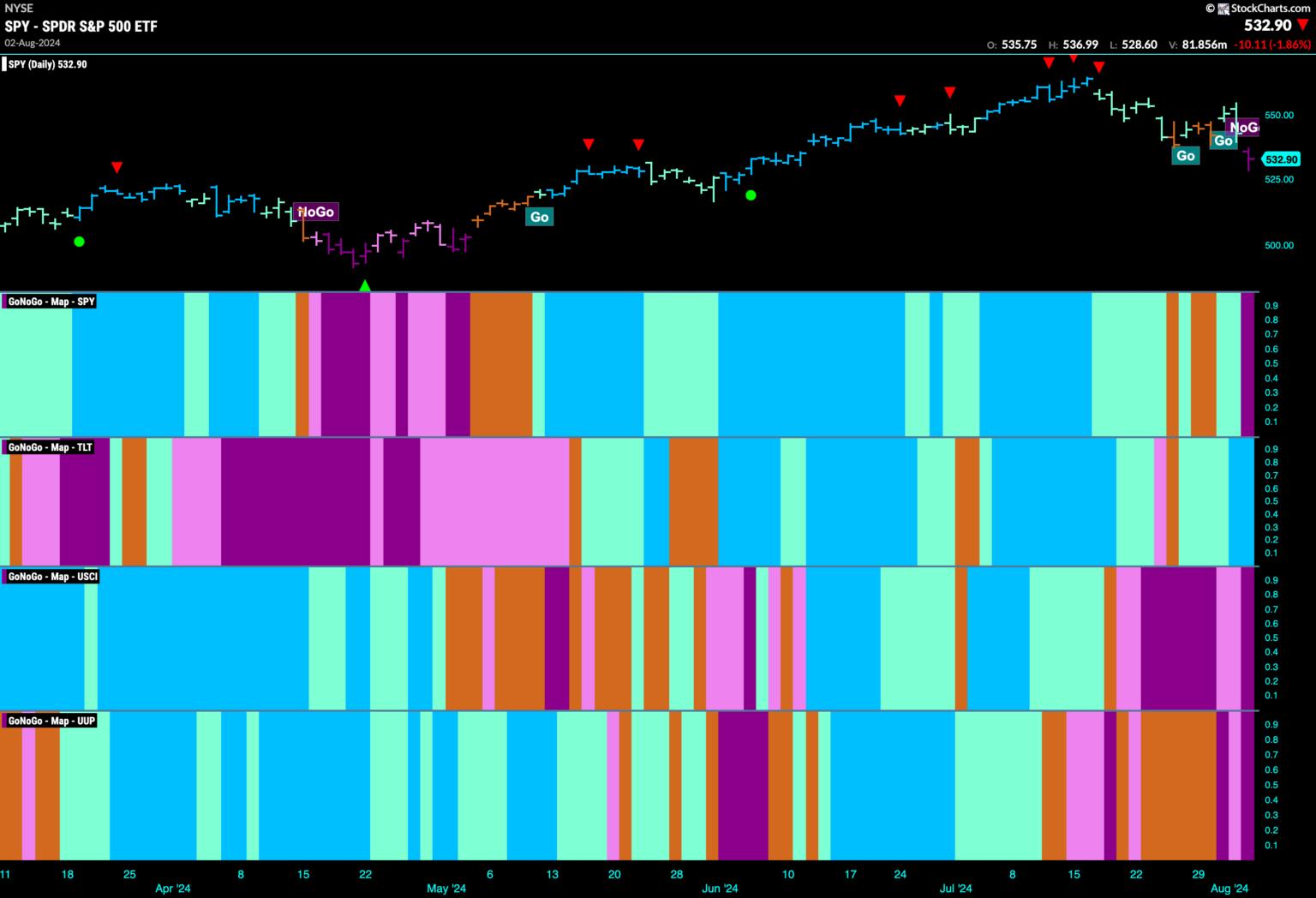

$SPY Falls into Strong “NoGo” Trend

Price gapped lower on Friday, and GoNoGo Trend painted a first strong “NoGo” bar. This came after a week where GoNoGo Oscillator had been below zero on heavy volume. Later in the week we saw the oscillator get rejected at that level as more sellers entered the market. We had also seen uncertainty in the trend with several amber “Go Fish” bars sprinkled in with the weaker aqua trend color. We will watch to see if the oscillator falls further into negative territory this week which would add downward pressure on price.

An inflection point has arrived on the weekly chart. A second weaker aqua bar tells us that the longer term trend continues to be weak after the last Go Countertrend Correction Icon (red arrow) told us price may struggle to go higher in the short term. GoNoGo Oscillator has fallen to test the zero line from above and we will watch to see if it finds support here at this level. A break into negative territory would likely signal a deeper correction.

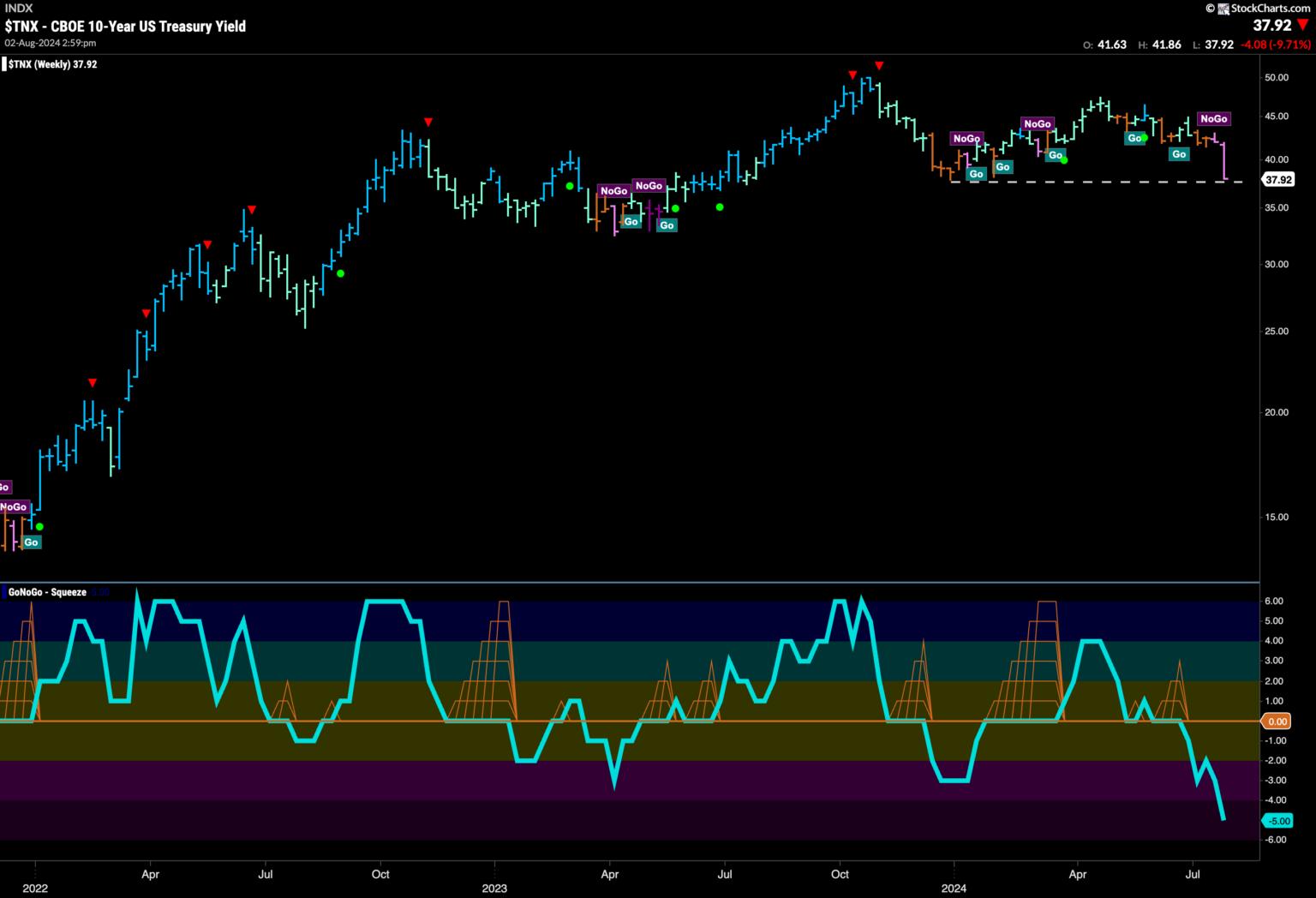

Treasury Rates Crash to New Lows in “NoGo” Trend

This week we saw another uninterrupted string of purple “NoGo” bars as price fell every single day of the week. As the week progressed price accelerated its move to the downside. We now see that GoNoGo Oscillator is in oversold territory at an extreme value of -6.

The weekly chart below shows that price has fallen to test prior lows. A second weaker pink “NoGo” bar has pushed price down to horizontal levels that could provide support. We also see that GoNoGo Oscillator has fallen into oversold territory on the weekly chart as well at a value of -5.

The Dollar Reverts Back to “NoGo” Trend

After a lot of uncertainty last week, the dollar fell back into a “NoGo” trend this week with pink and purple bars. On the last day of the week, price gapped lower and is now testing support from earlier lows that we see in the chart. GoNoGo Oscillator broke out of a Max GoNoGo Squeeze on heavy volume as well which tells us that momentum is resurgent in the direction of the “NoGo” trend. We will watch to see if price can fall to new lows this week.