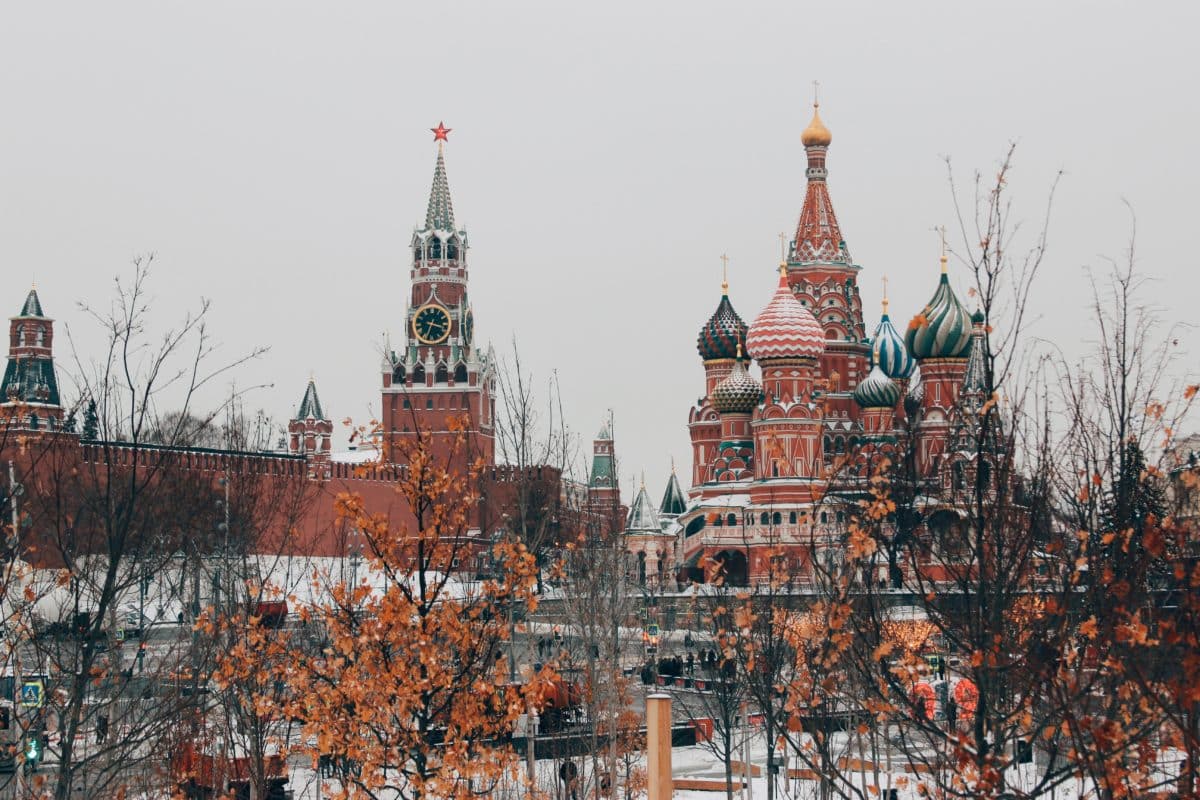

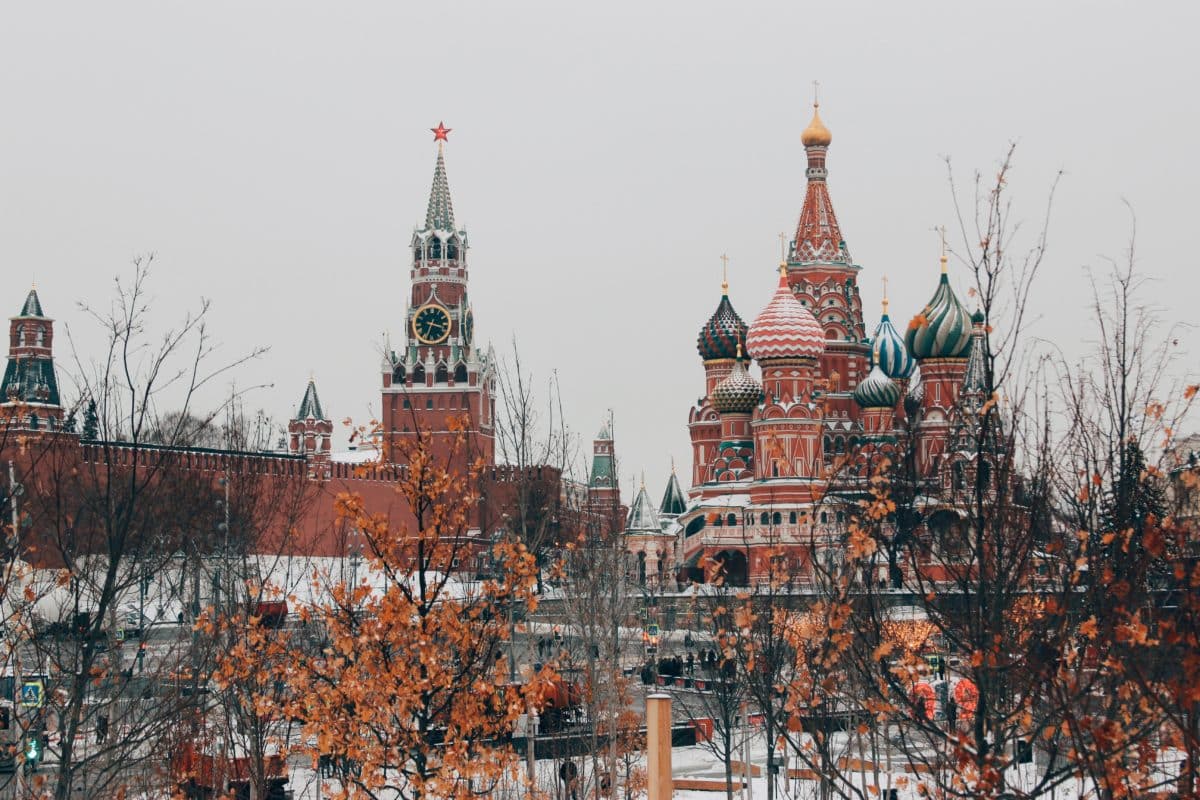

Russia’s Growth Forecast Doubles to 2.6%

- The IMF has significantly upgraded Russia’s economic growth forecast to 2.6% from a previous 1.1%.

- Despite this optimistic projection, the IMF warns of substantial challenges ahead for Russia, emphasizing the impact of a war economy.

- A massive increase in defence spending contrasts with a significant exodus of skilled labour, highlighting the complex dynamics.

In an unexpected turn of events, the Russian economy has displayed remarkable resilience in the face of relentless Western sanctions. Following its full-scale invasion of Ukraine nearly two years ago, analysts had predicted a dire economic future for Russia. However, the International Monetary Fund (IMF) recently revised its growth forecast for Russia. It doubled the expected pace of economic growth from 1.1% to 2.6%. This revision highlights an unforeseen economic stamina that has surprised many.

The Shadows Behind the Growth

Despite the positive forecast, the future of Russia’s economy is filled with uncertainty. IMF Managing Director Kristalina Georgieva pointed out Russia’s inherent challenges, describing its current state as a “war economy.” The economic model has shifted, with the government channelling substantial resources into defence and military efforts. This pivot towards a war economy is reminiscent of historical patterns, characterized by increased production for military purposes and reduced consumer consumption. The significant increase in military expenditure, with defence and security spending expected to constitute around 40% of total budgetary outlays, represents a major redirection of the country’s fiscal resources.

Over 800,000 Skilled Workers Exit

Russia’s economic challenges have worsened due to the departure of more than 800,000 individuals. Many of these individuals are highly skilled workers. They work in critical sectors such as IT and sciences. The ongoing conflict and its societal impacts drive this exodus. It has deprived Russia of a crucial segment of its workforce. The loss of these professionals undermines the country’s current economic capabilities. It also poses a long-term detriment to its developmental prospects.

In summary, while Russia’s economy has demonstrated unexpected durability amid sanctions and geopolitical tensions, this resilience is accompanied by significant challenges. The substantial shift towards defence spending and the concerning trend of skilled labour flight illustrates the complex trade-offs faced by a nation in turmoil. As the international community continues to observe closely, the true cost of Russia’s current economic strategy remains to be seen, presenting a picture of resilience overshadowed by looming difficulties.

The post Russia’s Growth Forecast Doubles to 2.6% appeared first on FinanceBrokerage.