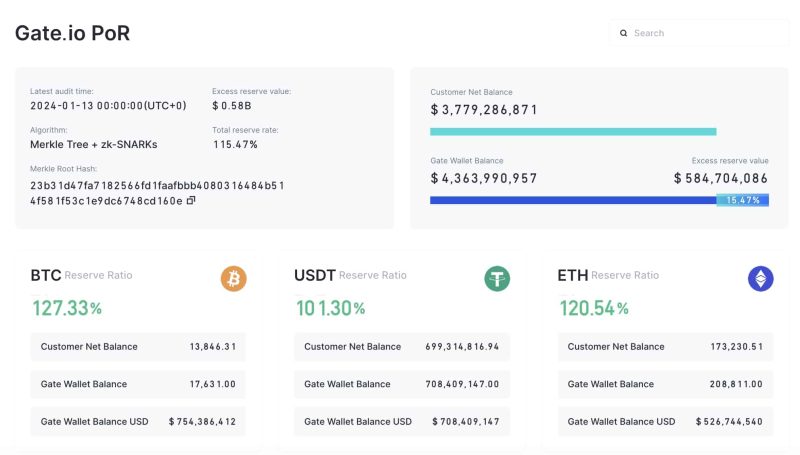

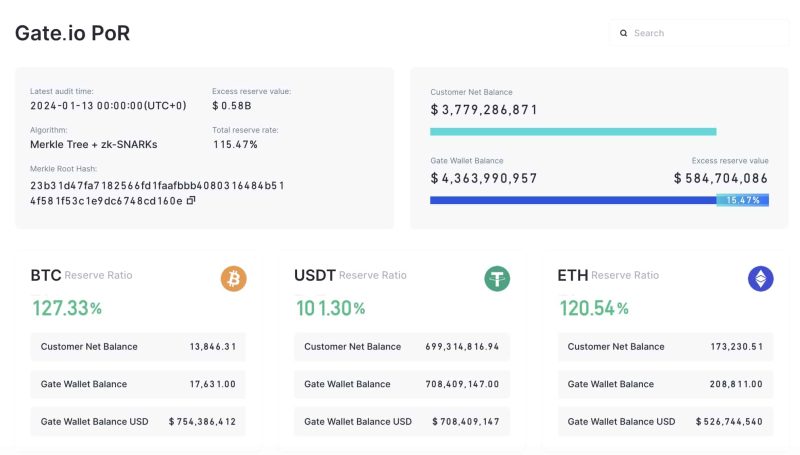

Jan. 24th, Panama – Gate.io, a leading crypto exchange and Web3 innovator, has released its January 2024 Proof of Reserves (PoR), verifiably demonstrating $4.3 billion in total held assets with a ratio of 115.47%, representing over $584 million retained in excess of user deposits. The latest report also demonstrates an increase of $1.1 billion in value since the previous report this past November and marks the fourth year Gate.io has produced user-verifiable PoR.

Gate.io’s newest report covers more than 171 digital assets, the most of any exchange. An additional 59 assets have been included since the previous report, 26 of which are BRC-20 tokens, including SATS, ORDI, MUBI, TRAC, NALS, PIZA (PIZABRC), PEPE (PEPEBRC), and others. Each of the 171 assets is reported to have a reserve ratio of ≥100%. Additional key data from the report includes:

Total Reserve Value: 4,363,990,957 USD Extra Reserves: 584,704,086 USD Total Reserve Ratio: 115.47% BTC: 127.33% ETH: 120.54% USDT: 101.30% USDC: 129.34%

Dr. Lin Han, Founder and CEO of Gate.io, said: “Transparency matters for individuals and industry integrity. It ensures users can safely and confidently participate in the market and promotes best practices among exchanges. We will continually respond to input from users, external experts, and peers to ensure security, privacy, and transparency in our reserves reporting.”

Gate.io’s PoR Method Praised by Auditor

Late last year, Gate.io introduced significant zero-knowledge verifiability and privacy upgrades to its PoR, expanded the list of reflected assets, and committed to more regular reporting. A January audit by the renowned blockchain security firm Hacken praised the new method as “a testament to a strong foundation in cryptographic implementation,” finding that it contributes “significantly to the field.”

Gate.io has been conducting PoR since 2020 when it became one of the first to produce third-party audited, use-verifiable PoR with a Merkle tree approach. This was repeated in 2022 before FTX’s collapse, when Gate.io encouraged others to follow, releasing its method as open source. The November 2023 report utilized the previously mentioned upgrades, making Gate.io’s PoR the most extensive of any exchange.

Gate.io’s January 2024 reserves report data is available on its PoR portal, where users can independently verify whether their account and deposits were reflected and view other detailed information.

About Gate.io:

Established in 2013, Gate.io is one of the world’s earliest cryptocurrency exchanges and a leader among compliant and secure digital asset platforms, offering diverse trading services with 100% user-verifiable Proof of Reserves. Further, the platform has consistently ranked as one of the top 10 cryptocurrency exchanges based on liquidity and trading volume on CoinGecko. Besides its primary exchange services, Gate.io has diversified its ecosystem to offer decentralized finance, research and analytics, venture capital investing, wallet services, startup incubation, and more. The platform currently serves more than 13 million active users worldwide.

Press Contact: Elaine Wang Email: elaine.w@gate.io

Disclaimer: The text above is a press release that is not part of Cryptonews.com editorial content.

The post Gate.io’s Proof of Reserves Report Reveals $4.3B in Assets with 115% Reserve Ratio for 171 Assets appeared first on Cryptonews.