Binance’s Controversial Settlement: A Closer Look

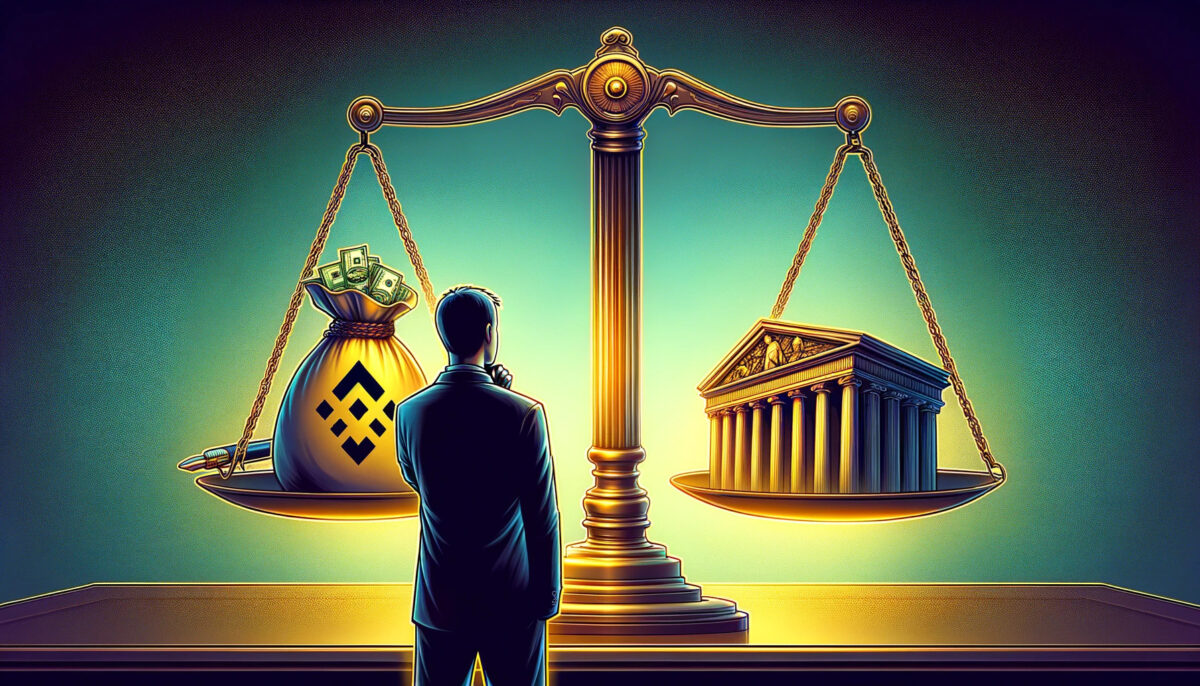

In November, a significant settlement involving Binance, the world-renowned cryptocurrency exchange, and its founder Changpeng Zhao, caught the attention of the financial world. The U.S. Department of Justice’s settlement imposed a hefty $4.3 billion fine and mandated Zhao’s resignation as CEO. This action, initially hailed as a landmark enforcement, raises questions about its sufficiency given Binance’s controversial activities.

Binance, notorious for its dealings with entities like ISIS and Hamas and its involvement in various cryptocurrency frauds, somehow managed to avoid a more severe fate. The key to their survival lies in an aspect of the settlement less talked about: the appointment of an independent compliance monitor by the Treasury Department’s Financial Crimes Enforcement Network. This monitor, endowed with extensive access to Binance’s records and operations, is set to keep a vigilant eye on the company for five years.

This monitoring arrangement affords the U.S. government an unprecedented level of oversight over Binance. It includes a thorough review of all Binance transactions from 2018 to 2022 and the authority to report any suspicious activities. The Justice Department values this level of access and information, hoping it will lead to numerous high-profile criminal prosecutions.

CFTC’s Role and the Challenge of Regulatory Compliance

The Commodity Futures Trading Commission (CFTC) also played a significant role in the settlement. They previously sued Binance and Zhao for violations of the Commodity Exchange Act. As part of the resolution, Binance agreed to pay $1.35 billion in penalties, sever ties with non-compliant trading firms, and establish a more robust governance structure.

Interestingly, the CFTC Chair, Rostin Behnam, took a subtle jab at the SEC’s absence from the settlement during the announcement. The SEC has its ongoing legal battle with Binance over various regulatory violations, including the operation of unregistered exchanges and the sale of unregistered securities. This ongoing conflict highlights the broader challenges facing the cryptocurrency industry, particularly regarding compliance with traditional securities regulations.

Binance’s Reluctance and Future Challenges

Despite these regulatory steps, concerns persist about the overall compliance of cryptocurrency exchanges like Binance. They still resist adopting standard safeguards required of traditional securities exchanges and broker-dealers. This reluctance poses significant risks to investors and the integrity of the financial system.

One telling incident in this saga was Binance’s interaction with the audit firm Mazars. Binance’s attempt at transparency with a “proof-of-reserves” report ended in controversy and further skepticism, especially after Mazars withdrew from working with crypto firms altogether.

As the new CEO of Binance, Richard Teng, maintains a secretive stance regarding the company’s operations, the question remains whether entities like Binance can truly align with regulatory expectations and ethical business practices. The settlement, while significant, seems to be just the beginning of a long journey towards a more regulated and transparent cryptocurrency industry.

The post Binance’s Controversial Settlement: A Closer Look appeared first on FinanceBrokerage.