IoT Analytics published an analysis based on the “Predictive Maintenance & Asset Performance Market Report 2023–2028” report and highlights 5 key insights related to the $5.5 billion predictive maintenance market.

Key insights:

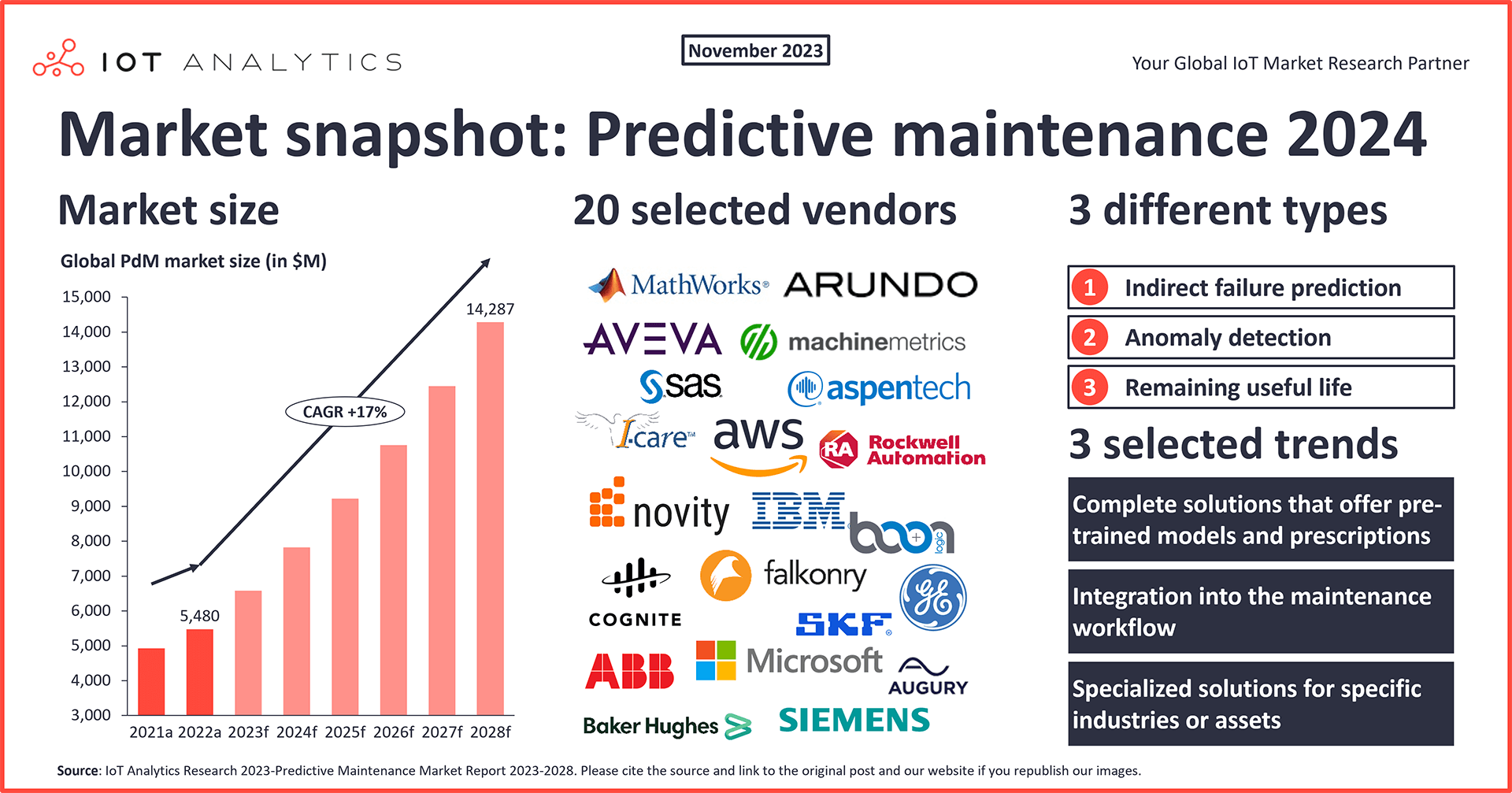

- The global predictive maintenance market grew to $5.5 billion in 2022–a growth of 11% from 2021—with an estimated CAGR of 17% by 2028, according to the Predictive Maintenance and Asset Performance Market Report 2023–2028.

- With median unplanned downtime costs larger than $100,000 per hour, the importance of accurately predicting failures of large assets has never been higher.

- This article shares 5 key highlights of the predictive maintenance market: 1) The market is valued at $5.5 billion, 2) there are 3 different types of predictive maintenance, 3) predictive maintenance software tools share 6 features, 4) predictive maintenance is commonly being worked into the maintenance workflow, and 5) successful standalone solutions vendors specialize in an industry or asset.

Key quotes:

Knud Lasse Lueth, CEO at IoT Analytics, remarks: “Predictive Maintenance continues to be one of the leading use cases for Industry 4.0 and digital transformation, especially in process industries where asset failures can quickly go into the hundreds of thousands of dollars. It is great to see that the market is moving ahead with AI integration into existing APM and CMMS systems and that prediction accuracies are improving. Nonetheless, we still have a long way to go as false alerts remain commonplace.”

Fernando Brügge, Senior Analyst at IoT Analytics, adds that “Predictive maintenance is reaching new heights of maturity and sophistication thanks to the rapid advancements in artificial intelligence, hardware, and data engineering. We are at the point where these technologies enable us to collect, process, and analyze massive amounts of data from multiple sources, and use them to build more accurate and reliable models of machine health and behavior, as well as to determine potential courses of action to fix machine issues. In this way, predictive maintenance is not only a smart way to optimize equipment performance and lifecycle, but also a strategic way to enhance operational efficiency and competitiveness in a rapidly evolving industrial space.”

Predictive maintenance market: 5 highlights for 2024 and beyond

One accurately predicted failure of a large asset is worth more than $100,000 in many industries.

Our latest research highlights, among many other things, that the median unplanned downtime cost across 11 industries is approximately $125,000 per hour. With critical unplanned outages in facilities in industries such as oil and gas, chemicals, or metals occurring several times a year, an investment into predictive maintenance can amortize with the first correct prediction.

Unfortunately, there is a flip side: the accuracy of many predictive maintenance solutions is lower than 50%. This creates headaches for maintenance organizations that often run to an asset to find it is perfectly fine, eroding trust in the entire solution.

That said, vendors have been making strides to increase prediction accuracy, with more data sources and better analysis methods becoming available, including AI-driven analysis. There are positive signs that this determination for better prediction accuracy is helping end users: our research indicates that 95% of predictive maintenance adopters reported a positive ROI, with 27% of these reporting amortization in less than a year.

General search interest in predictive maintenance and related concepts has been on the rise for the last 12 years. Online searches for the term have grown nearly threefold since we initiated coverage on the topic in 2017 and have outgrown condition-based maintenance and asset performance management (APM) related searches.

Indeed, predictive maintenance appears to be well on track to be the must-have killer application we made it out to be in 2021.

In this fourth installment of our predictive maintenance market coverage, we look at 5 important highlights to note about the market going into 2024:

-

1. The predictive maintenance market is valued at $5.5 billion (2022)

2. There are 3 different types of predictive maintenance, with anomaly detection on the rise

3. Predictive maintenance software tools share 6 common features

4. Integration into the maintenance workflow is becoming important

5. Successful standalone solutions vendors specialize in an industry or asset

Highlight 1: The predictive maintenance market is valued at $5.5 billion

The predictive maintenance market reached $5.5 billion in 2022. Uncertain economic conditions and other manufacturing priorities in the last 2 years resulted in 11% market growth between 2021 and 2022. With companies reinvesting in efficiency, safety, and operational performance, we expect the market for predictive maintenance to grow to 17% per year until 2028.

Our research indicates that industries with heavy assets and high downtime costs are driving the adoption of predictive maintenance solutions (e.g., oil & gas, chemicals, mining & metals).

Highlight 2: There are 3 different types of predictive maintenance, with anomaly detection on the rise

As the market has evolved, 3 noticeable predictive maintenance types have developed:

-

1. Indirect failure prediction

2. Anomaly detection

3. Remaining useful life (RUL)

The difference between these largely comes down to the objectives, methods of data analysis, and type of output/information they provide. RUL is the hardest to achieve due to resource demands and environmental factors that make it difficult to scale. Indirect failure prediction has been the most used approach, but our research indicates that anomaly detection is on the rise.

1. Indirect failure prediction

The indirect failure prediction approach generally takes a machine health score approach based on a function of maintenance requirements, operating conditions, and running history. This approach often relies on general analysis to yield this score, though supervised machine learning methods can be used if a significant amount of data is available.

Benefits:

- Scalability – Indirect failure prediction can be more easily scaled since they rely on equipment manufacturers’ specifications that are more or less the same across machines of the same type.

- Cost effective – Indirect failure prediction can use existing sensors and data, reducing the need for additional instrumentation.

Limitations:

- Failure time-window accuracy – Indirect failure prediction does not give a timeline of when machines will fail. This can be a problem for organizations with very costly downtimes (e.g., heavy equipment industries).

- Dependent on historical data – Indirect failure prediction’s effectiveness relies on the availability of extensive historical data for accurate modeling.

2. Anomaly detection

Anomaly detection is the process of finding and identifying irregularities in the data (i.e., data points that deviate from the usual patterns or trends). While the indirect failure prediction and RUL approaches use failure data to predict future failures, anomaly detection uses the “normal” asset profile to detect deviations from the norm. These deviations can indicate potential problems, such as faults, errors, defects, or malfunctions, that need to be detected and addressed before they cause serious damage or downtime. This approach makes it easier when there is not a good repository of failure data, and it often relies on unsupervised machine learning.

Benefits

- Low data and hardware requirements – Anomaly detection models can identify issues without being trained on failure data. Further, since these models need less data, they do not demand high computing power.

- High scalability and model transferability – Anomaly detection models are trained on normal operation data, so they can easily be applied to different machines without retraining or adaptation.

Limitations

- Failure time-window accuracy – As with indirect failure prediction, anomaly detection models do not give a timeline of when machines will fail, which can be a problem for organizations with very costly downtimes.

- Presence of false positives – While most solutions in the market can distinguish between critical and noncritical anomalies, the choice of unsupervised machine learning models is still important as it can affect how well this distinction can be made (e.g., autoencoders and generative adversarial networks do not capture the complexity of normal operations).

3. Remaining useful life (RUL)

RUL is the expected machine life or usage time remaining before the machine requires repair or replacement. Life or usage time is defined in terms of whatever quantity is used to measure system life (e.g., distance traveled, repetition cycles performed, or the time since the start of operation).

This approach relies on condition indicators extracted from sensor data—that is, as a system degrades in a predictable way, data from the sensors match the expected degradation values. A condition indicator can be any factor useful for distinguishing normal operations from faulty ones. These indicators are extracted from system data taken under known conditions to train a model that can diagnose or predict the condition of a system based on new data taken under unknown conditions.

Predictions from these RUL models are statistical estimates with associated uncertainty, resulting in a probability distribution.

Benefits

- Failure prediction time-window – RUL is especially useful for industries where maintenance is very costly and needs advanced planning, such as heavy-equipment industries.

- Output robustness – Since RUL estimates rely on high-quality and detailed data, they tend to be more robust and reliable.

Limitations

- Resource demand – Training large models requires powerful computing hardware, especially if done on-premises.

- Model transferability and scalability – Different environments and usage patterns can cause different failure modes for the same type of equipment. This means the model needs to be retrained for each specific case, reducing its scalability and generalizability.

Highlight 3: Predictive maintenance software tools have 6 common features

Software is the largest segment of the predictive maintenance tech stack, making up 44% of the predictive maintenance market in 2022.

Our report shows that even though most successful predictive maintenance software vendors specialize in industries or assets, there are 6 common features between their various solution software suites:

-

1. Data collection

2. Analytics and model development

3. Pre-trained models

4. Status visualization, alerting, and user feedback

5. Third-party integration

6. Prescriptive actions

We will delve further into these features and offer an example snapshot for each from various software vendors. The examples are to help readers understand some approaches to these common features.

Feature 1: Data collection

Data collection tools within predictive maintenance software collect, normalize, and store data on asset health/condition parameters. They also collect other data types needed to identify and predict upcoming issues, such as business and process data.

Snapshot:

US-based predictive maintenance software vendor Predictronics offers PDX DAQ, an application that allows users to synchronize data collection from multiple sources for any given period of time. The solution creates a database that harmonizes all the timestamps from different sensors, which Predictronics claims yields the necessary information for analysis and producing real-time, impactful results.

Feature 2: Analytics and model development

Analytics and model development tools within Predictive Maintenance software analyze, interpret, and communicate data patterns, including analytics discovery (e.g., RCA, AD modules) and modeling (e.g., feature engineering and model selection and testing).

Snapshot:

US-based predictive maintenance software vendor Falkonry (recently acquired by IFS) offers Workbench within its Time Series AI platform, a low-code ML-based solution aiming to help users—specifically, operational practitioners, including production, equipment, or manufacturing engineers—discover patterns such as early warning or stages of deterioration in complex physical systems. It also aims to enable users to analyze large amounts of data and build predictive models.

Feature 3: Pre-trained models

Pre-trained models are just that: ready-to-use models typically designed for specific assets in specific industries. These models include capabilities and references for specific assets or failure modes (e.g., fouling for heat exchangers, wear and corrosion for fans, or valve leakage for compressors). These are meant to help end users see examples of models so they can build on them or develop custom predictive maintenance algorithms.

Snapshot:

US-based asset management software vendor AspenTech (recently acquired by Emerson), offers Mtell, an application that includes pre-populated, industry-specific asset templates to help users select sensors for common asset categories and AI functionality to create and deploy models quickly for PdM applications (e.g., for specific compressors, turbines, and blowers).

Feature 4: Status visualization, alerting, and user feedback

Status visualization, alerting, and user feedback tools within predictive maintenance software automatically communicate asset-related data/insights for various personas. These insights often include status dashboards and automatic alerts that trigger work orders or corrective actions, maintenance planning, and optimization. These tools also enable users to provide feedback concerning the accuracy of alerts.

Snapshot:

US-based analytics software vendor SAS Institute offersAsset Performance Analytics, which includes status dashboards and automatic alerts intended to notify operations staff and managers of impending failure so that organizations have time to identify and fix issues before they become costly problems.

Feature 5: Third-party integration

Third-party integration enables users to connect their predictive maintenance software to other software systems and workflow management tools, such as ERP, MES, CMMS, APM (more on APM integration in Highlight 4), and Field Service.

Snapshot:

SKF, a Swedish bearing and seal manufacturing company also offering maintenance products, offers a condition monitoring and predictive maintenance solution that interfaces with existing plant control systems (e.g., MES or SCADA) and other external dashboards (e.g., ERP). It also provides insights to operators in the field via alarms and visualization on handheld devices.

Feature 6: Prescriptive actions

Prescriptive action features typically suggest the optimal actions to take in case of an (upcoming) failure. These actions are typically prioritized by criteria that are set when the algorithm is designed.

The actions that are prescribed by the software vary depending on the nature and urgency of the issue. They may require multiple steps or interventions. For instance, some actions may involve automatically adjusting the equipment parameters or informing the maintenance and operation teams about the necessary procedures to ensure equipment efficiency.

Snapshot:

Marathon, a predictive maintenance software solution from Norway-based Arundo, provides a feature known as Investigations that aims to provide the workflow and instructions to resolve equipment problems according to prescribed corporate standards.

Highlight 4: Integration into the maintenance workflow is becoming important

In its early days, predictive maintenance was mostly a standalone solution developed by startups to address specific customer needs. However, our report highlights a notable trend of sophisticated predictive maintenance solutions integrating into larger APM and computerized maintenance (CMMS) solutions.

APM is a strategic equipment management approach designed to help optimize the performance and maintenance efficiency of individual assets and entire plants or fleets. APM aims to improve asset efficiency, availability, reliability, maintainability, and overall life cycle value.

Various APM vendors are introducing predictive maintenance software tools within their APM offerings. The solutions aim to tie the different capabilities into 1 thread:

- Knowing when a machine will fail and mapping how failures could affect production or output

- Estimating how much fixing or preventing an issue will cost

- Making recommendations on whether it is worth fixing or preventing a problem

By including a sophisticated predictive maintenance solution in an end-to-end asset flow, APM players are trying to become the main partners for their customers’ digitalization journeys.

Our report lists 9 key components of APM:

-

1. Asset health monitoring

2. Maintenance optimization

3. Reliability analysis

4. Integrity management

5. Performance optimization

6. Failure prediction <- Predictive maintenance resides here

7. Digital asset twin

8. Sustainability management

9. Energy optimization

We assess in our report that improving the failure prediction module of APM solutions is currently one of the key initiatives of leading APM vendors.

Highlight 5: Successful standalone solutions vendors specialize in an industry or asset

Our research found that 30% of predictive maintenance vendors offer standalone, industry- or asset-specific solutions. By tailoring their efforts to specific niches in which they have acquired domain knowledge, they can discern the types of equipment and industries in which their solutions offer the most end-user benefits.

Snapshot:

Israel-based data science company ShiraTech Knowtion uses its equipment expertise in its offering of Predicto, an industrial IoT platform focused on industrial maintenance teams. The platform enables reading and processing of sensor data from production plants, ideally based on its own multisensing devices (iCOMOX). The company has developed specific offerings for motors, pumps, conveyors, and pipes. These asset-tailored offerings enable the company to scale.

6 considerations for predictive maintenance vendors

Six questions that predictive maintenance vendors should ask themselves based on insights in this article:

-

1. Market growth and strategy: Given the market’s growth to $5.5 billion and the projected increase to $14.3 billion by 2028, how can our company align its strategy to capitalize on this market expansion?

2. Accuracy improvement: Considering the current lower-than-50% accuracy of many predictive maintenance solutions, what innovative approaches or technologies can we adopt to enhance the accuracy of our predictions?

3. ROI communication: How can we better communicate the positive ROI of predictive maintenance to potential customers, especially those who are skeptical due to past experiences with inaccurate solutions?

4. Industry specialization: Given that the most successful vendors are specialized in specific industries, assets, or use cases, should we consider narrowing our focus, and if so, in which areas?

5. Data collection and integration: Are we effectively collecting the right kinds of data (including business and process data) and integrating it into the right IT systems for optimal predictive maintenance?

6. Software tool features: Do our software tools encompass the 6 common features identified in the report (data collection, analytics and model development, pre-trained models, status visualization, third-party integration, prescriptive actions), and are they competitive in the current market?

8 considerations for those looking to adopt or update predictive maintenance solutions

Eight questions that those looking to adopt or update predictive maintenance solutions should ask themselves based on insights in this article:

-

1. Solution type suitability: Which type of predictive maintenance solution (indirect failure prediction, anomaly detection, or RUL) best aligns with our specific maintenance needs and operational goals?

2. Integration with existing systems: How easily can predictive maintenance solutions integrate into our existing maintenance workflows and asset management systems?

3. Vendor specialization: Should we look for a vendor specialized in our industry, specific assets, or use cases, and how would that benefit us over a generalist provider?

4. Data collection and analysis: Do we have the necessary infrastructure for effective data collection and analysis to support a predictive maintenance system?

5. Accuracy and trustworthiness: How can we evaluate and ensure the accuracy of the predictive maintenance solution to build trust within our maintenance team?

6. Scalability and future growth: How scalable are the predictive maintenance solutions, and can they accommodate our future growth?

7. Software features and functionality: Do the software tools offered by vendors have all the key features we need, such as data collection, analytics, and third-party integration?

8. Market trends and innovation: Given the evolving nature of the predictive maintenance market, how can we stay informed about the latest innovations and ensure that our solution remains cutting-edge?

The post Predictive maintenance market: 5 highlights for 2024 and beyond appeared first on IoT Business News.