Is XAIR Stock a Buy or Sell? Latest Predictions

Today’s XAIR stock price stands at $0.4597, trading higher by $0.0397 (+9.4524%) in this session. Beyond Air, Inc. is a biopharmaceutical and medical device company in the commercial stage. It established the Lungfit system, creating a nitric oxide (NO) generator and delivery method tool.

Beyond Cancer and Beyond Air are its two operating segments. The company treats newborns with persistent pulmonary hypertension with Lungfit PH. Moreover, it is developing LungFit GO to treat nontuberculous mycobacteria, along with LungFit PRO for treating viral lung infections.

These infections include bronchiolitis and community-acquired pneumonia (COVID-19) in hospitalised patients. Additionally, the business is working on ultra-high concentration NO for solid tumour treatment in the Phase 1 clinical trial.

It has partnered with the Hebrew University of Jerusalem, LLTD’s Yissum Research Development Company, to purchase the commercial rights to neuronal nitric oxide synthase inhibitors. The doctors use the latter for treating neurological disorders like autism spectrum disorder.

The company, which first entered the market in 2011 under the name AIT Therapeutics, Inc., established its headquarters in Garden City, New York. In June 2019, it rebranded to Beyond Air, Inc., reflecting a shift in focus and strategy. For investors, this stock may be appealing due to the company’s evolving business model and its potential for growth, as evidenced by its rebranding efforts and continuous development within its industry.

XAIR Stock Price Prediction

In the latest XAIR stock forecast, Wall Street analysts have set an average price target of $3.75 for Beyond Air Inc. This projection is based on three separate 12-month price targets issued within the past three months. The analysts’ estimates range from a low of $3.50 to a high of $4.00. Notably, the average target price of $3.75 represents a significant 792.86% increase from the current price of $0.42.

The sales forecast for the upcoming quarter is $881.00K, with a price range of $784.00K to $1.05M. Moreover, sales for the preceding quarter totalled $470.00K.

Over the last 12 months, XAIR has exceeded its sales projections by 0.00%, while the industry has surpassed sales projections by 46.68% during the same period. This means XAIR did not perform as well as its industry in the previous calendar year. Consequently, the earnings estimate for Beyond Air stock for the upcoming quarter is -$0.34, with a price range of -$0.40 to -$0.28. The EPS for the prior quarter was also -$0.36.

On the other hand, XAIR has outperformed its estimated profit percentage (75.00%) over the last 12 months, while the industry has exceeded its estimate by 57.28% during the same period. Thus, over the past year, this stock has outperformed its rivals on the market.

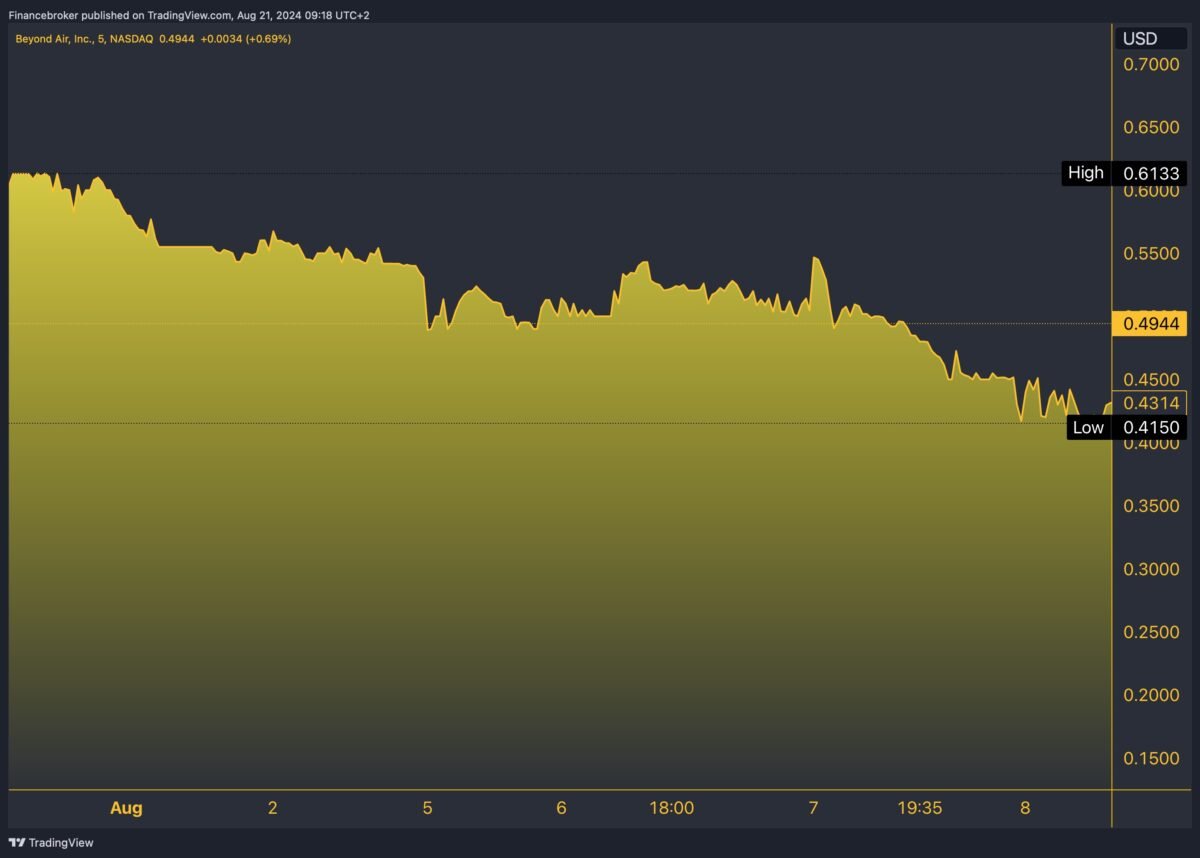

XAIR/USD 5 DAY-Chart

XAIR Stock News

Here are the newest figures of the Beyond Air Stock:

- Profit Margin: 0.00%

- Operating Margin: -1,988.43%

- Return on Assets: -63.48%

- Return on Equity: -219.18%

- Revenue: 1.78M

- Revenue Per Share: 0.05

- Quarterly Revenue Growth: 1,057.60%

- EBITDA: -58.36M

- Net Income Avi to Common: -58.35M

- Diluted EPS: -1.6400

- Total Cash: 21.37M

- XAIR Total Cash Per Share: 0.46

- Total Debt: 17.7M

- Total Debt/Equity: 100.01%

- Current Ratio: 2.63

- Book Value Per Share: 0.35

- Operating Cash Flow: -49.04M

- Levered Free Cash Flow: -25.8M

- 52 Week Range: -88.40%

- S&P 500 52-Week Change: 19.16%

- 52 Week High: 3.9000

- 52 Week Low: 0.4150

- 50-Day Moving Average: 0.8111

- 200-Day Moving Average: 1.4368

- Average Vol (3 months): 824.12k

- Average Vol (10 days): 440.23k

- Shares Outstanding: 45.9M

- Implied Shares Outstanding: 45.9M

- Float: 34.38M

- Percentage Held by Insiders: 18.44%

- Percentage Held by Institutions: 35.36%

- Shares Short (7/15/2024): 1.06M

- Short Ratio (7/15/2024): 0.57

- XAIR Short % of Float (7/15/2024): 2.61%

- Short % of Shares Outstanding (7/15/2024): 2.31%

- Shares Short (prior month 6/14/2024): 3.37M

Is XAIR Stock Buy or Sell?

According to the technical indicators, XAIR is currently rated as a Strong Sell. The 20-day EMA for the stock is 0.77, but its share price has dropped to $0.42. However, the Moving Averages Convergence Divergence (MACD) index for Beyond Air Inc. (XAIR) stands at -0.17, indicating a potential Buy.

This divergence in opinion could stem from the stock’s current low price, which might appeal to bargain hunters looking for an undervalued investment. Additionally, the company’s diversification into multiple medical sectors could offer long-term growth opportunities, making it an attractive option for investors willing to take on some risk.

XAIR Stock Market: The Fiscal 1st Quarter’s Earnings

XAIR earnings for the fiscal quarter that ended June 30, 2024, were $0.7 million. For comparison, the company reported $0.1 million in earnings for the fiscal quarter ending June 30, 2023, and $0.5 million for the previous quarter ending March 31, 2024.

For the three months ending June 30, 2024, the cost of revenue stood at $1.0 million, as opposed to $0.3 million for the same period in 2023. Thus, the cost of revenue exceeded the revenue itself. The experts think that the depreciation of LungFit devices caused this downfall.

Expenses related to research and development reached $6.0 million in the three months ending June 30, 2024, while the company spent $4.7 million for the same period in 2023.

The team also noted a reduction in stock compensation expenses by $0.6 million ($0.2 million for Beyond Cancer and $0.4 million for Beyond Air) and a $0.3 million decrease in growth rate costs for Beyond Cancer research, alongside a $0.9 million increase in salaries ($0.3 million for Beyond Air and $0.6 million for Beyond Cancer).

Despite this data, the consensus for this stock is currently a moderate Buy. If it declines further or reports more losses, that rating might change, though. However, its low price and the company’s diversification across various medical sectors may still make it appealing to long-term investors who are willing to take on some risk in the hopes of future growth potential.

The post XAIR Stock Price Target and Forecast for 2024 appeared first on FinanceBrokerage.