SelfKey Soars 48.99% in 24H, and Its Market Cap Hits $51M

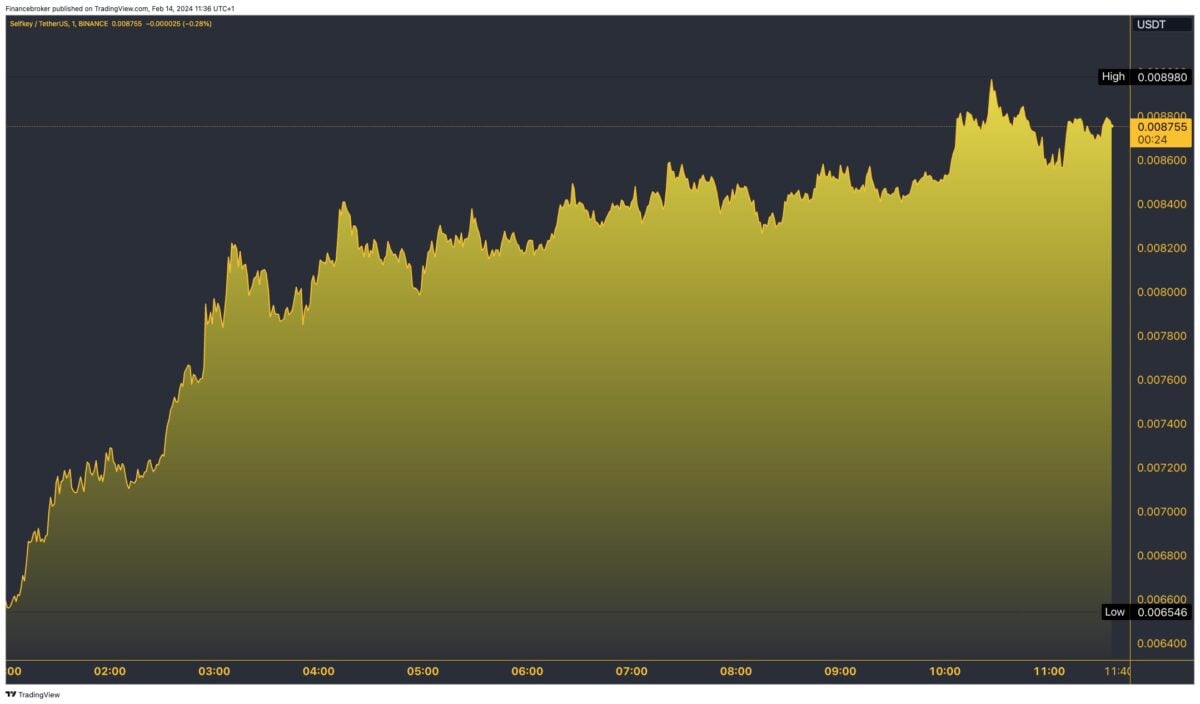

Today, the crypto traders observed a significant rally in SelfKey (KEY). Its price hit $0.008503, marking a staggering 48.99% increase over the last 24 hours and an impressive 61.76% jump over the past week. The token, with a circulating supply of almost 6 billion KEY tokens, now boasts a market capitalization of $51,088,347. SelfKey’s standing within the crypto market has improved significantly, as well. Currently, it outperforms both the broader market trends and its peers within the Polygon Ecosystem.

Trading Volume Surges to $73.54M Amidst Bear Market

The trading volume for SelfKey has spiked to $73,540,953.34, indicating a heightened interest and activity in the token. Notably, market participants have traded KEY tokens most actively on Binance, with significant volumes also reported on TokoCrypto and BingX. Considering the current bearish sentiment pervading the broader cryptocurrency market, this surge in trading volume and price is remarkable.

Crypto Market Dips: A Contrast to SelfKey’s Rise

Contrastingly, the broader crypto market presents a starkly different picture, with an overall flat and predominantly red performance. The global crypto market cap has slightly decreased by 0.7% to $1.8 trillion in the last 24 hours, with a marginal 1.47% increase in total market volume. Despite the general downturn, Bitcoin and Ethereum have maintained their dominance, albeit with slight decreases in their respective values.

Factors Influencing the Current Market

Several factors contribute to the current market dynamics:

- Bitcoin’s Influence: As the market leader, Bitcoin’s performance significantly impacts the broader crypto ecosystem. Currently hovering around the $50,000 mark, its slight dip has had a cascading effect on other cryptocurrencies.

- Market Sentiment: The prevailing bearish sentiment, underscored by a spike in liquidation activity and bearish trading volume, suggests a cautious or pessimistic outlook among investors.

- Economic Indicators: Global economic conditions and investor sentiment (the Fear and Greed Index’s increase for one), play pivotal roles in influencing market movements.

SelfKey’s Performance in Context

SelfKey’s remarkable performance, set against the backdrop of a broader market downturn, underscores the token’s resilience. It also seems to appeal to investors, especially those who are seeking growth opportunities amidst volatility. KEY’s substantial price increase, coupled with a significant trading volume, further highlights a growing investor interest.

While the current market sentiment appears bearish, the cryptocurrency market is known for its volatility and potential for rapid changes. SelfKey’s recent surge may inspire confidence among investors, possibly signaling a bullish trend for the token in the near term. However, as the market navigates through economic uncertainties and shifting investor sentiments, the trajectory for SelfKey and the broader market is still uncertain.

Amidst the challenges pervading the wider cryptocurrency market, the notable surge in SelfKey’s value makes this token stand out. Investors and market analysts are keenly monitoring this trend, eager to discover whether it will persist and perhaps signal a broader market turnaround.

The post SelfKey Soars 48.99% in 24H, and Its Market Cap Hits $51M appeared first on FinanceBrokerage.