What is Noncontrolling Interest? Get All The Information.

Key Takeaways:

- Noncontrolling interest (NCI) is when someone owns less than half of shares without decision-making power, valued based on net assets.

- Many public shareholders have a small stake, usually 5% to 10%, while others have more control and voting rights.

- Noncontrolling interests can be direct (pre and post-acquisition equity) or indirect (post-acquisition equity) in consolidated financial statements.

- Activist investors with significant shares can impact financial statements positively, influencing operational improvements, restructuring, and environmental/social policies.

Have you ever thought about what noncontrolling interest is? Why should you learn more about it as a true expert?

A non-controlling interest means owning less than 50% of shares and having no decision-making power. These interests are valued based on entity net assets and do not consider potential voting rights.

Most shareholders in public companies have a small ownership stake; even 5% to 10% is seen as significant. This contrasts with controlling or majority interests, where investors possess voting rights and influence over company decisions.

Noncontrolling Interests in Consolidated Financial Statements

Common stock shareholders in a parent company have certain rights. These rights include receiving cash dividends based on earnings and voting on important decisions regarding assets and liabilities.

These decisions can encompass matters like mergers or the sale of subsidiary companies. Noncontrolling interests can be categorized as direct or indirect in consolidated financial statements.

A direct noncontrolling interest refers to sharing subsidiary equity before and after acquisition. On the other hand, an indirect noncontrolling interest only involves sharing the subsidiary’s equity after acquisition.

Common stock shareholders in a parent company have certain rights. These rights include receiving cash dividends based on earnings and voting on important decisions regarding assets and liabilities.

Activist Investors and Their Impact

Investors who acquire significant shares, typically ranging from 5% to 10%, can become activist investors. This may result in them having a redeemable, noncontrolling interest.

Their actions can significantly impact financial statements, fostering positive change such as operational improvements, restructuring efforts, or influencing decisions regarding environmental and social policies.

These investors collaborate with company leaders, propose changes, and unite with fellow shareholders to wield greater influence.

This collaboration can impact consolidated financial statements, advocating for enhancements and policy shifts.

Noncontrolling Interest Example by a professional

A company buys 80% of XYZ’s shares, while smaller shareholders own the remaining 20% of the company. The noncontrolling interest represents the equity stake of these minority shareholders in the subsidiary.

Over time, the goodwill initially recognized on the acquisition date is gradually expensed, following accounting rules and undergoing regular tests for potential losses.

Why is financial modelling so important?

Financial modelling is important. It guarantees that the consolidated financial statements accurately display the subsidiary’s net income.

However, suppose both the parent and minority shareholders pay more than the fair value of the net assets acquired. In that case, any excess amount is recorded as goodwill within the consolidated financial statements.

This helps account for ownership interests in the subsidiary not attributable to the parent company.

What is goodwill in this situation?

Goodwill represents an additional expenditure incurred when purchasing a company at a price exceeding its fair market value. Over time, the goodwill is recorded as an expense, following accounting rules and tested for potential losses.

As the Financial Accounting Standards Board (FASB) endorsed, these accounting practices align with the purchase-acquisition accounting method.

What is redeemable noncontrolling interest?

A redeemable NCI is a small ownership share in a company held by investors with limited decision-making power. They can choose to sell their share later on.

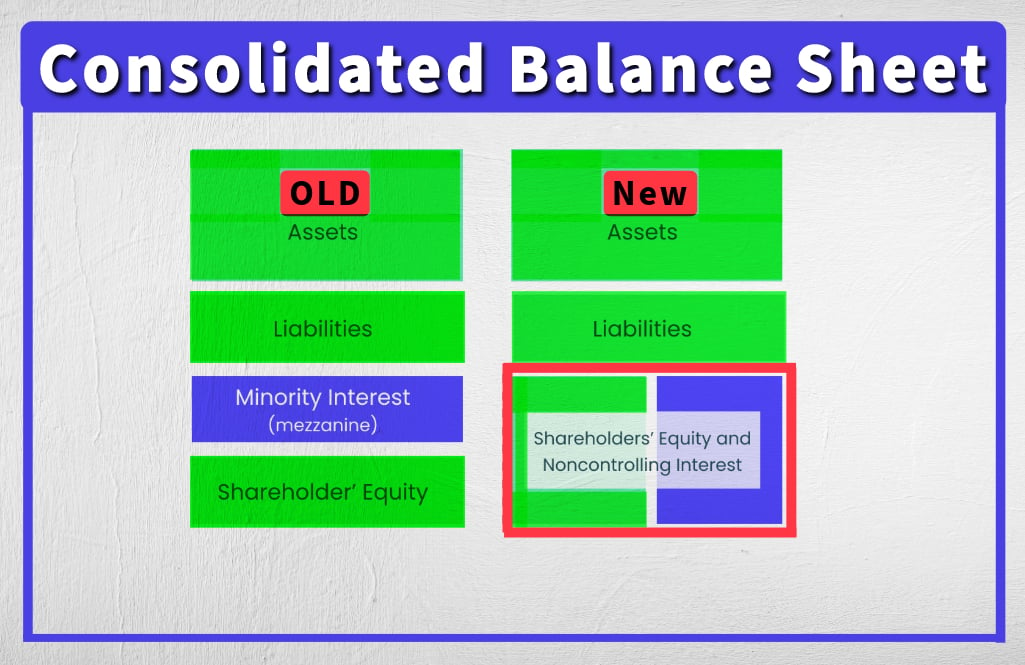

Noncontrolling interest on balance sheet – Explained.

Now, let’s take a closer look at the noncontrolling interest on balance sheet:

NCI is displayed in the equity section of the parent company’s balance sheet. It is separate from the parent’s equity, not between liabilities and equity.

It’s crucial to clearly show and combine the parent’s net income and noncontrolling interest on the income statement.

Previously, net income for noncontrolling interest was considered an expense in calculating consolidated net income.

Valuing Acquired Net Assets

Previously, when a company acquired a subsidiary without full control, it only recognized the fair value of the controlling interest.

The noncontrolling interest was recognized at its carrying value. The noncontrolling interest was recorded at its carrying value.

Current rules mandate recording the purchased subsidiary’s net assets at fair value, regardless of the controlling interest level.

Example A – Purchase Price Allocation

Alpha purchased 80% of Sierra’s shares for $22.00 each in cash. Sierra’s stock price averaged $20.00 per share in the three days following the purchase.

Transaction costs were $15, and Alpha’s corporate tax rate was 30%. Sierra’s pre-transaction financial results match the book and tax balance sheets.

The main question is how to calculate goodwill using the old and new rules. We need to record the subsidiary’s net assets at their fair value, regardless of controlling or noncontrolling interest.

How to calculate net income attributable to noncontrolling interest?

- Determine the shareholder equity’s net asset worth.

- Multiply the net asset value by the fraction representing minority ownership.

- Document the outcome on the balance sheet.

Bottom line

Understanding noncontrolling interest is crucial for investors and financial professionals as it impacts financial statements, valuation, and accounting practices.

Compliance with accounting rules and clarity in financial reporting are essential to represent the interests of controlling and noncontrolling stakeholders accurately.

The post What is Noncontrolling Interest? Get All The Information. appeared first on FinanceBrokerage.