The Arcblock token (ABT) has gained significant attention from investors and market analysts due to its recent surge in price. What caused this surge in the ABT token’s price, and what is its potential future trajectory?

Navigating The 237% Weekly Leap

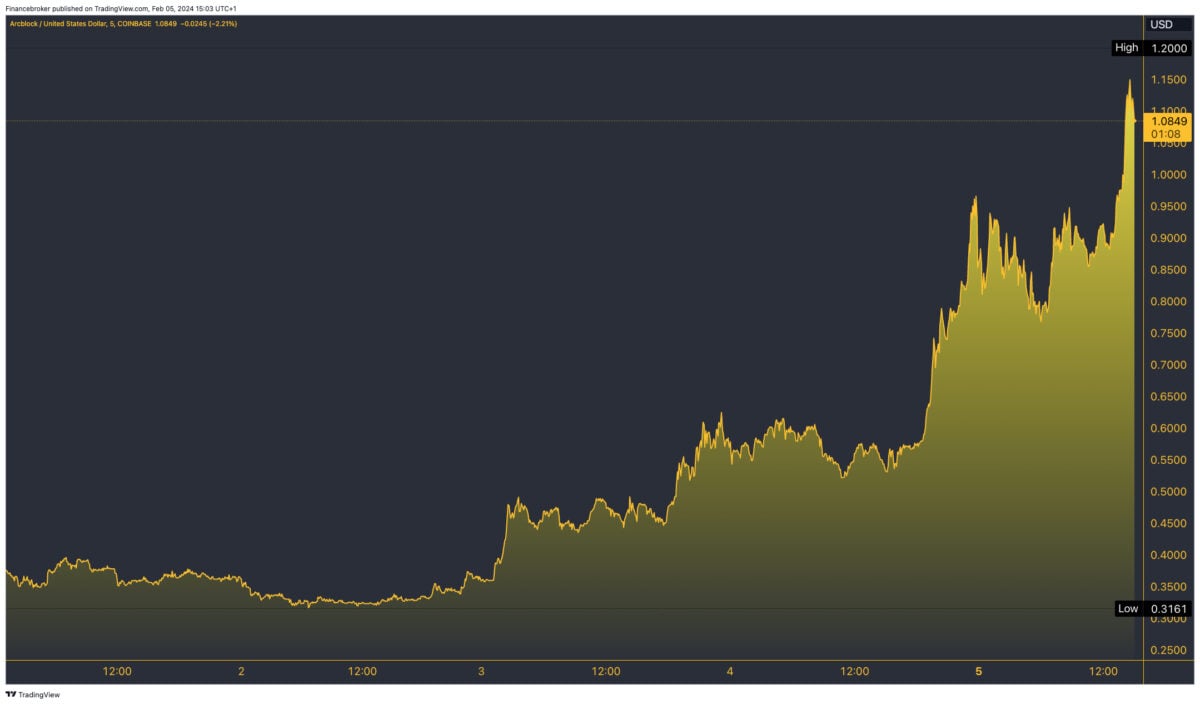

The ABT token, the native digital token of the Arcblock platform, has witnessed a remarkable uptick in its market value. In the last 24 hours, the price soared to $1.05, marking an 83.28% increase. Over the past week, it skyrocketed by 237.65%. This surge has catapulted Arcblock’s market capitalization to an impressive $88,921,019, positioning it at #403 in the global cryptocurrency rankings.

Understanding Arcblock’s Background

Founded in 2017, Arcblock is designed as a comprehensive solution for decentralized applications (dApps) and blockchain technology. It focuses on removing barriers that have slowed blockchain adoption among the general public. The platform’s unique infrastructure, integrating cloud computing and blockchain technology, provides an efficient and user-friendly environment for dApp developers.

Recent Market Dynamics

Analysts attribute the recent price surge of the ABT token to several factors, including an increase in trading volume, heightened investor interest, and overall market dynamics. Notably, the ABT token’s performance is significantly better than its peers in the Ethereum ecosystem, which only saw a 12.70% increase in the same period.

ABT Token’s Price Prediction

At this point, the trajectory of the Arcblock token appears optimistic. The digital token’s recent performance, coupled with its robust technological foundation, suggests potential for further growth. In the near future, if the bullish trend continues and market conditions remain favourable, we could see the ABT token testing its previous resistance levels. However, it’s crucial for investors to stay vigilant, as the crypto market is known for its volatility.

Final Thoughts on Arcblock Token

The Arcblock token stands out as a digital asset with promising potential in the blockchain space. Its recent surge in price and market cap shows the growing interest and confidence among investors. Traders should keep an eye on the ABT token’s performance, market trends, and the broader technological advancements in blockchain to understand its future direction better.

The world of cryptocurrencies is dynamic and often unpredictable, but assets like the Arcblock token showcase the innovative spirit and potential of this digital era. Whether you’re an investor, a tech enthusiast, or simply curious about the future of digital tokens, the journey of the ABT token is one to watch.

The post Arcblock Token’s Rapid Rise: Analyzing the 83% Surge appeared first on FinanceBrokerage.