Today, the Jupiter token (JUP) experienced a significant decline, shedding a large portion of its value. As a digital currency analyst, I have closely monitored these fluctuations to offer a deeper understanding of Jupiter’s performance and its implications for investors.

Background of Jupiter Token

To grasp the current market scenario fully, understanding Jupiter’s role in the cryptocurrency universe is essential. Jupiter (JUP) stands out in the decentralized finance (DeFi) sector as a digital token. Its aim to provide secure and scalable blockchain solutions has attracted attention, marking it as a significant player in the market.

Recent Market Performance

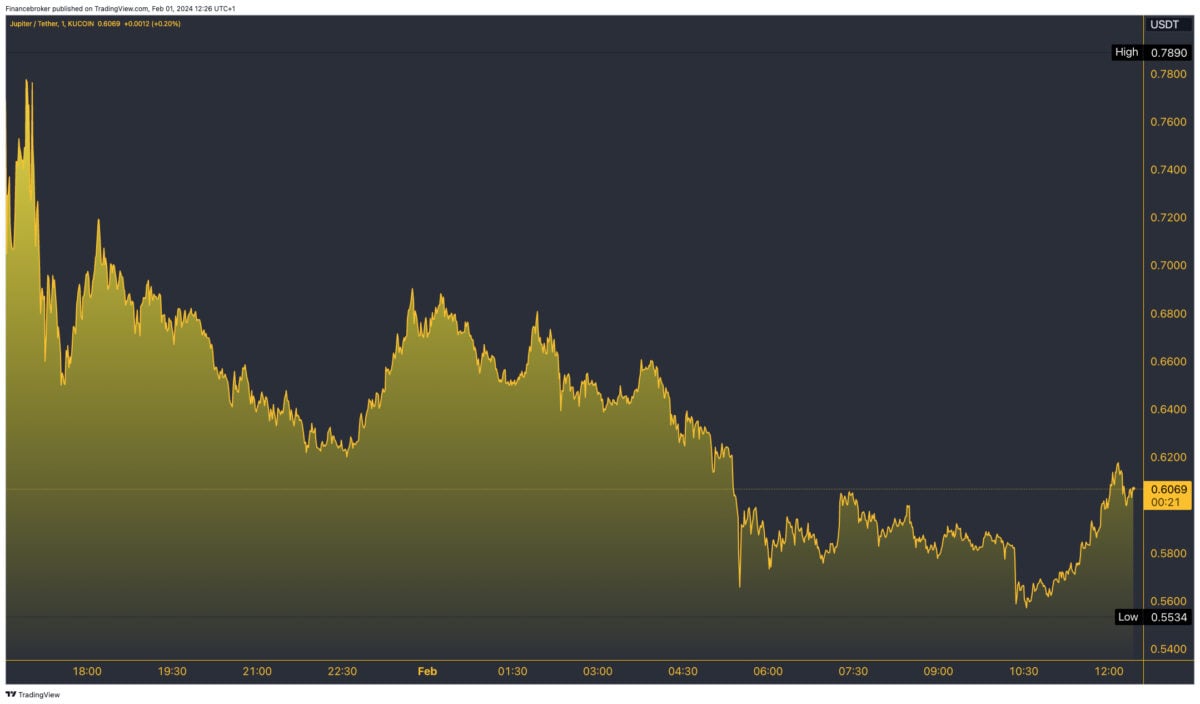

Recently, the JUP token has been on a tumultuous journey. It currently trades at $0.5817, with a 24-hour trading volume of $835,491,842.79, indicating vigorous market activity. However, it is important to highlight its drastic 70.92% price drop in the last 24 hours, contrasting with a general price increase over the past week. This volatility illustrates both the inherent uncertainties of the crypto market and the specific challenges and opportunities Jupiter token faces.

Jupiter Token: Market Data Insights

JUP token, with a market capitalization of $773,218,937 and ranked #87, commands a significant presence in the crypto space. Its circulating supply of 1.35 billion, out of a total and max supply of 10 billion tokens, plays a crucial role in its market dynamics.

Historical Price Movements

Understanding the JUP token’s historical price movements is vital. It reached an all-time high of $2.00 on Jan 31, 2024, just about 20 hours ago, and is now 71.30% below that peak. In contrast, its all-time low was $0.5639, recorded about an hour ago. This highlights the token’s extreme volatility within a short period.

Trading Platforms and Volume

JUP token sees its most active trading on Binance, primarily through the JUP/USDT pair. Its high trading volume and availability on platforms like Bybit and OKX make it easily accessible for investors.

Comparative Market Analysis

Over the past week, Jupiter’s price has remained relatively static, underperforming compared to the broader crypto market, which saw a 4.30% rise. It also lagged behind similar DeFi cryptocurrencies, which were up by 2.90%.

Jupiter Token Price Prediction and Final Thoughts

Predicting the future movement of Jupiter token, or any cryptocurrency, remains challenging due to market unpredictability. However, after its recent all-time high and subsequent correction, some level of stabilization might be expected soon. Investors should prepare for potential fluctuations but also monitor broader market trends and Jupiter’s developments for informed decision-making.

In conclusion, Jupiter token’s journey highlights the volatile and dynamic nature of digital currencies. Staying updated on market trends and data is crucial for those interested in this digital token’s path.

The post Jupiter Token plunged by 70.6%. What’s Next? appeared first on FinanceBrokerage.