Last week, digital asset investment products witnessed a significant surge in inflows, totaling an impressive $1.18 billion, albeit subject to a T+2 settlement.

Digital Assets Investments Still Behind ETPs Despite Record Inflows

While this influx of capital is noteworthy, it falls just shy of the record set during the launch of futures-based Bitcoin (BTC) ETFs in October 2021, which amassed a staggering $1.5 billion, according to CoinShares report.

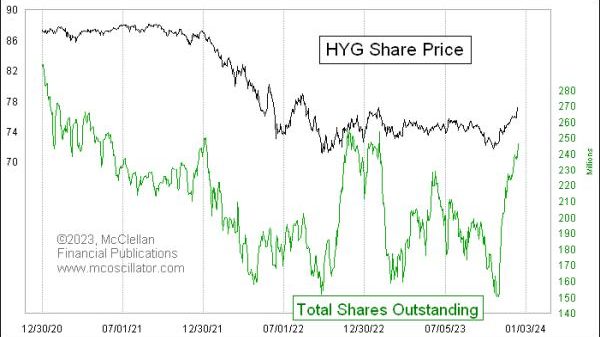

The report said that trading volumes for exchange-traded products (ETPs) reached a historic high, clocking in at $17.5 billion for the week.

“These trading volumes represented almost 90% of daily trading volumes on trusted exchanges last Friday, unusually high as they typically average between 2%-10%.”

The United States led the pack, attracting $1.24 billion in inflows last week, with Switzerland also seeing notable inflows of $21 million.

Meanwhile, Europe and Canada experienced outflows, with Canada witnessing $44 million, Germany $27 million, and Sweden $16 million in capital moving out.

This phenomenon is likely due to basis traders seeking to transition their investments from Europe to the United States.

Bitcoin remains a dominant force, drawing in $1.16 billion in inflows last week, equivalent to approximately 3% of the total assets under management (AuM).

In contrast, short-bitcoin products saw modest inflows amounting to $4.1 million.

Ethereum attracted $26 million in inflows, while XRP garnered $2.2 million. Solana received only $0.5 million in inflows during the same period.

The influx of capital extended beyond cryptocurrencies as blockchain equities witnessed substantial inflows totaling $98 million.

Over the past seven weeks, these investments have garnered a cumulative inflow of $608 million, underlining the growing investor interest in the blockchain and cryptocurrency sectors.

Bitcoin Posts Worst Monthly Performance

Bitcoin posted its worst streak in about a month after the US Securities and Exchange Commission approved spot Bitcoin ETFs.

The leading cryptocurrency remained highly volatile in the past few days, ultimately trading little changed at $42,655.

The recent decline marked the longest losing streak for Bitcoin since mid-December, leaving investors puzzled about the cryptocurrency’s short-term direction.

The catalyst for this recent bout of turbulence was the introduction of nearly a dozen US exchange-traded funds (ETFs) focused on cryptocurrencies. This includes offerings from investment giants BlackRock Inc. and Fidelity Investments.

These ETFs officially started trading on January 11th, and Bitcoin initially surged to a two-year high above $49,000 in response.

However, the enthusiasm quickly faded, and the cryptocurrency retraced its steps.

Market analysts have attributed the Bitcoin price action to a classic “buy-the-rumor, sell-the-fact reaction.”

Tony Sycamore, a market analyst at IG Australia Pty, noted that chart patterns suggest a possible slide to the $38,000 to $40,000 range for Bitcoin.

This pattern suggests that the excitement over the ETFs had been largely priced into the market, leading to profit-taking by some investors.

Supporters of Bitcoin argue that these US spot ETFs represent a significant milestone for the cryptocurrency. This also provides increased access for institutional and retail investors.

On the other hand, skeptics point to the tumultuous year that cryptocurrencies, particularly Bitcoin, experienced in 2022, which was marked by a deep crash and subsequent bankruptcies.

Despite a partial market rebound last year, concerns about wider adoption linger.

The post Digital Asset Investment Products See $1.18 Billion Inflows Amid Excitement Around Launch of Spot Bitcoin ETFs appeared first on Cryptonews.