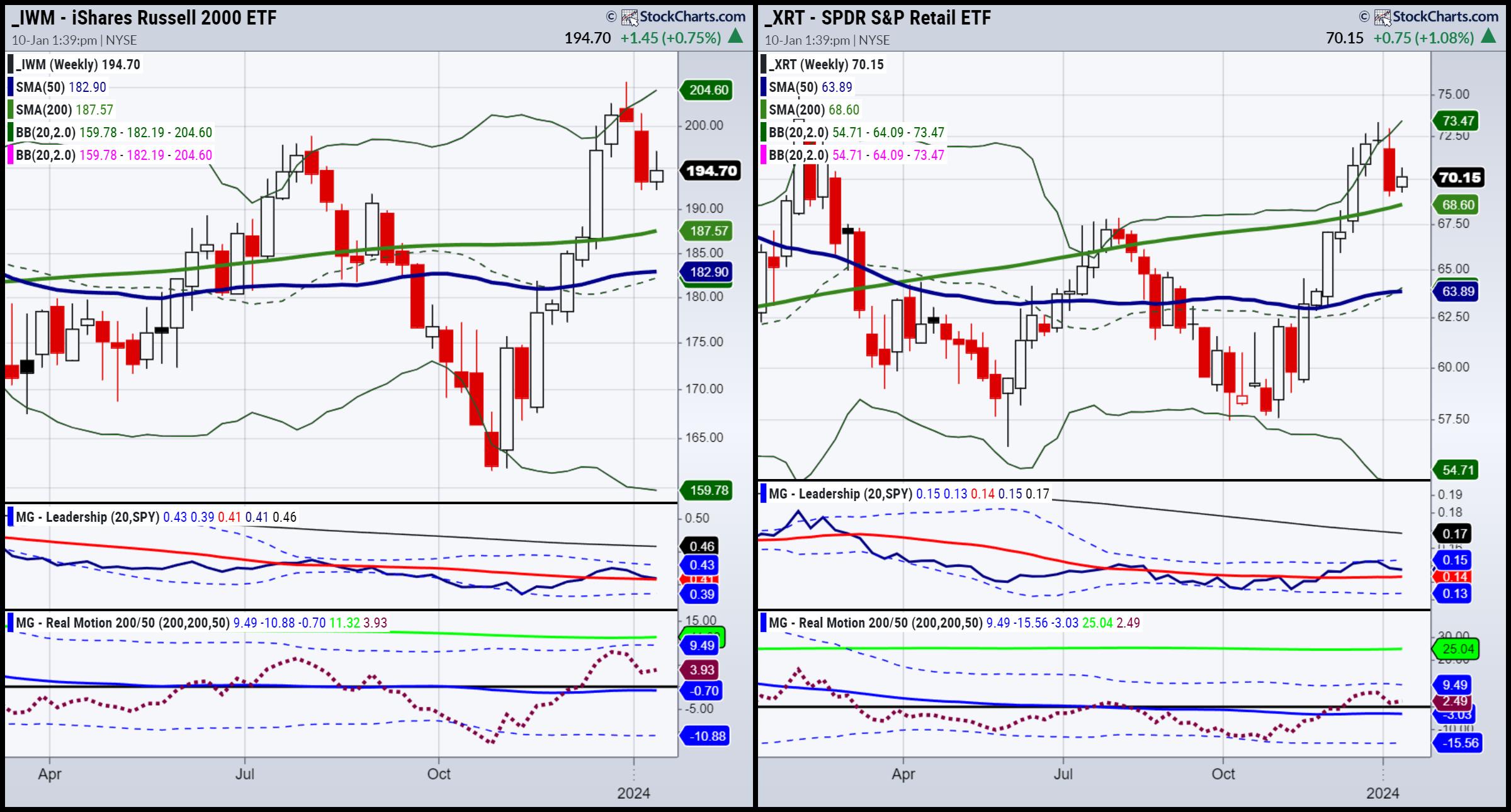

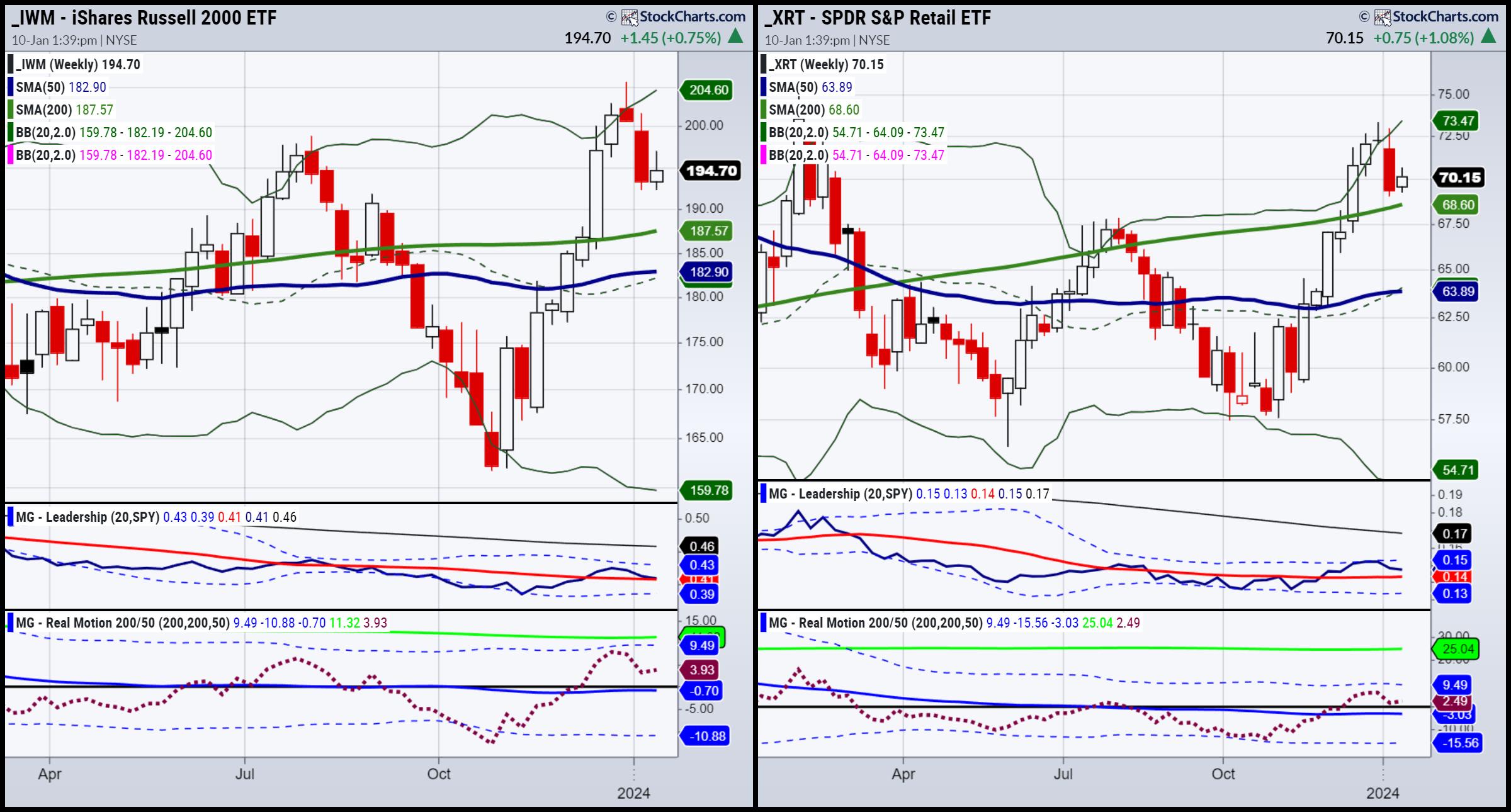

Looking at the Economic Modern Family (weekly charts), all of them, to date, peaked in December. The Russell 2000, Regional Banks, Transportation and Retail, as far as index and sectors go, backed off the most from their peaks. Semiconductors are more sideways since the peak, as well as Biotech (which remains the strongest sector right now).

This sets the stage for a January calendar reset — a range that is effective for the entire year (even though we get a new range in July) and will show itself next week.

For example, IWM’s January high, at 201.62, will most likely be the 6-month January calendar range high. The low thus far is 192.26, so unless that is violated, that could be the January calendar range low. That range is crucial to watch. Above, one must be bullish. Below, one must be cautious. And in between, one must exercise patience, as the market could chop.

We use small caps as a gauge for the overall economic sentiment. Although growth stocks shine, we believe that, without small caps, the growth stocks should sell off as well.

Retail is of particular interest, as some of my stock picks (my vanity trade) are doing well, while the ETF itself sits above key support that must hold. The growth space is getting crowded again, while the “inside sectors” show some wear and tear.

We have been here before. While Newton’s law states that things in motion stay in motion, we believe remaining agnostic overall on next major direction until these calendar ranges reveal themselves is wise.

What About Commodities?

The CPI number will be watched carefully. However, we are more interested in supply chain, geopolitics, the Fed on rates and the dollar trajectory. The dollar looks more vulnerable in the longer term, even with the recent pop.

Gold still looks poised, even though it is more rangebound now (another great 6-month calendar ranger to watch). And oil, also rangebound, is starting to consolidate between $70-73 a barrel. We remain of the opinion that commodities can take as long as late spring to early summer to pick back up. On the weekly charts, both GLD and USO are underperforming the SPY, which is risk on.

Momentum is in a bearish divergence in gold, which means that is possible to see lower prices, although we believe $2000 should hold. In oil, momentum is in a bullish divergence, which implies that this selling right now could be waning leaving room for an up move.

Check out some of the amazing picks and how they have performed!

This is for educational purposes only. Trading comes with risk.

If you find it difficult to execute the MarketGauge strategies or would like to explore how we can do it for you, please email Ben Scheibe at Benny@MGAMLLC.com, our Head of Institutional Sales. Cell: 612-518-2482.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

The Money Show is having a speaker’s special promotion for all of my followers to receive a Standard Pass for the Las Vegas MoneyShow for ONLY $99!!!!

Traders World Fintech Awards

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth.

Grow your wealth today and plant your money tree!

“I grew my money tree and so can you!” – Mish Schneider

“I grew my money tree and so can you!” – Mish Schneider

Follow Mish on X @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

In this video from CMC Markets, Mish continues with her analysis on gold, oil and gas, this time adding the dollar/yen currency pair and her outlook on the dollar longer term.

Mish talks how the January effect will reveal itself and her focus on the vanity trade in this appearance on Business First AM.

Mish covers oil, gold, natural gas, silver and sugar, plus teaches you how to use charts to determine short-term trading strategies in this video from CMC Markets.

Mish and Maggie Lake discuss inflation (given the wage component in the payroll report), Bitcoin (given the looming deadline for ETF news), the market outlook, small caps, and emerging markets on this video from Real Vision.

Mish covers war, energy, food and a pick of the day on Business First AM.

On the Tuesday, January 2 edition of StockCharts TV’s The Final Bar, Mish (starting at 22:21) talks small caps, retail, junk, and why all three matter in 2024 a lot.

In this appearance on BNN Bloomberg, Mish talks a particularly interesting chart, plus other places to invest in 2024.

In this appearance on Fox Business’ Making Money with Charles Payne, Mish talks with Cheryl Casone about Bitcoin’s volatility and why EVs may not be such a great place to invest in right now.

Recorded on December 28, Mish talks about themes for 2024 to look for, and tells you where to focus, what to buy, and what to avoid depending on economic and market conditions on Singapore Breakfast Bites.

Mish sits down with 2 other market experts to help you prepare for 2024 with predictions, picks, and technical analysis in StockCharts TV’s Charting Forward special.

Coming Up:

January 22: Your Daily Five, StockCharts TV

January 24: Yahoo! Finance

Weekly: Business First AM, CMC Markets

ETF Summary

- S&P 500 (SPY):: 480 all-time highs, 460 underlying support.

- Russell 2000 (IWM): 195 pivotal, 180 major support.

- Dow (DIA): Needs to hold 370.

- Nasdaq (QQQ): 390 major support with 408 resistance.

- Regional Banks (KRE): 50 support, 55 resistance.

- Semiconductors (SMH): 170 cleared with this sector back in the lead.

- Transportation (IYT): Needs to hold 250.

- Biotechnology (IBB): 135 pivotal support.

- Retail (XRT): 70 now key and pivotal.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education