Amid waning demand, cellular IoT module market faces another challenging quarter in Q3 2023, according to Counterpoint Research.

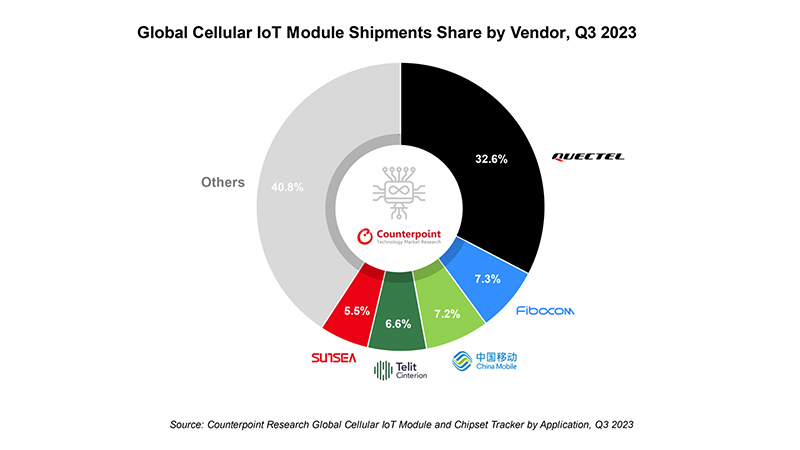

- Despite a decline in shipments, Quectel continued to lead, followed by Fibocom and China Mobile.

- The top five applications – smart meter, automotive, POS, router/CPE and telematics – accounted for over 60% of total cellular IoT module shipments.

- Against the backdrop of muted demand, full-year shipments for 2023 are expected to decline by 5%.

Global cellular IoT module shipments saw a 2% YoY decline in Q3 2023, according to Counterpoint’s latest Global Cellular IoT Module and Chipset Tracker by Application report.

Weaker demand, rising interest rates and cautious spending from enterprise IoT players are some of the important factors for slowdown in this market.

For the first time, the 5G market’s share in the global cellular IoT module market crossed 5%, indicating traction for 5G adoption. However, 5G applications are currently limited due to the lack of killer use cases and higher prices. We are only witnessing early adoption in the router/CPE, PC and automotive markets.

The IoT module market is undergoing a technology transition from 4G Cat 1 and NB-IoT to 4G Cat 1 bis. The low-cost and power-efficient 4G Cat 1 bis is becoming popular for many applications, including POS, smart meter, telematics and asset tracking.

Commenting on the market dynamics, Associate Director Mohit Agrawal said, “The top five applications, encompassing smart meter, automotive, POS, router/CPE and telematics, accounted for over 60% of total cellular IoT module shipments this quarter. Notably, only the smart meter and router/CPE segments observed positive growth in shipments, with other applications experiencing a decline.

India stands out as the only region to register positive growth in the global cellular IoT module market. Conversely, the market outside of China and India saw a steeper decline compared to China. Contrary to industry expectations, the market is not gaining momentum.”

- Quectel, the market leader, and Telit Cinterion, one of the leading international vendors, experienced a decline in shipments. This trend mirrors the prevailing conditions in both the Chinese and global IoT module markets. However, Quectel showed a slight improvement in performance in the global market on a sequential basis.

- In contrast, the other two vendors in the top five – China Mobile and Fibocom – saw positive growth. This growth was driven by smart meter, asset tracker and POS for China Mobile and router/CPE applications for Fibocom. China Mobile recently established a subsidiary, BILIN’ZHILIAN, to accelerate its module business growth.

- Certain Chinese brands such as Unionman, OpenLuat and Lierda exhibited positive performance from a niche perspective. Their growth was fuelled by applications in smart meters, asset tracking and POS.

Commenting on the future outlook, Senior Research Analyst Soumen Mandal said, “Global cellular IoT module shipments are projected to experience a 5% YoY decline in 2023. However, demand revival is expected by the second half of 2024, with substantial growth predicted for 2025, coinciding with the mass adoption of 5G and 5G RedCap.”

“In the long term, the cellular IoT module market holds promise and applications such as smart meter, router/CPE, POS, automotive and asset tracking will be driving most of the growth for this market.”

The post Global cellular IoT module shipments saw a 2% YoY decline in Q3 2023 appeared first on IoT Business News.