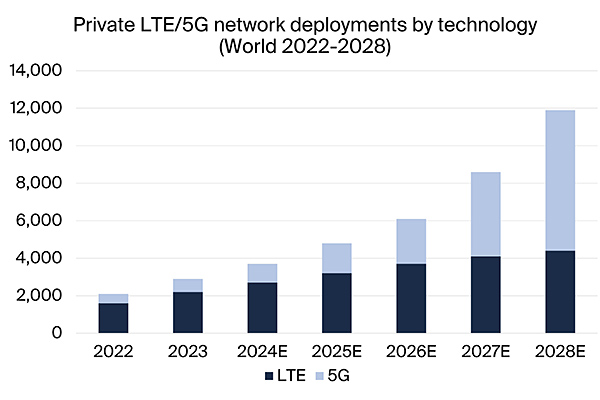

According to a new research report from the IoT analyst firm Berg Insight, there were a total of 2,900 private LTE/5G networks deployed across the world at the end of 2023, including trial and pilot deployments.

Private 5G network deployments are moving from trials to commercial operations and amounted to an estimated 700 networks whereof trials accounted for close to half. Until 2028, the number of private LTE/5G network deployments are forecasted to grow at a compound annual growth rate (CAGR) of 33 percent to reach 11,900 networks at the end of the period. Increasingly, the networks will be deployed into commercial operations faster as there is less need for use case testing. A meaningful number of private LTE network deployments will also be upgraded to 5G, starting in the next 2–3 years.

Berg Insight defines a private cellular network as a 3GPP-based private LTE/5G network built for the sole use of a private entity such as an enterprise or government organisation. Referred to as non-public networks by the 3GPP, private LTE/5G networks use spectrum defined by the 3GPP and LTE or 5G NR base stations, small cells and other radio access network (RAN) infrastructure to transmit voice and data to edge devices.

“The major RAN vendors (Ericsson, Nokia and Huawei) all play significant roles as integrated solution providers and are challenged by a number smaller RAN equipment providers”, said Fredrik Stalbrand, Principal Analyst, Berg Insight.

Nokia counts the largest number of private network deployments with more than 635 private cellular network customers at the end of Q2-2023.

Mr. Stalbrand continued:

“The vendors increasingly pursue channel-led sales strategies, and have developed ecosystems of mobile operators, system integrators, VARs and consulting partners to bring solutions to market.”

A number of small cell and other RAN equipment providers including Airspan Networks, Baicells, CommScope, JMA Wireless, Mavenir, Samsung Networks, Sercomm and ZTE provide competitive LTE/5G radio products and in some cases complete private network offerings.

Important specialised core network software vendors include Druid Software, Athonet (acquired by HPE in June 2023), as well as Affirmed Networks and Metaswitch (both part of Microsoft since mid-2020). In total, EPC/5GC offerings are available from close to 30 vendors. A third category is IT-centric players like Cisco and HPE. These companies focus on delivering fully integrated Wi-Fi and private LTE/5G solutions, enabling network managers to administer Wi-Fi and private LTE/5G networks through a single pane of glass. Celona is a new entrant in the space, backed by NTT Data and Qualcomm, offering its integrated private cellular solution in a single SaaS subscription.

The post Private LTE/5G network deployments reached 2,900 at the end of 2023 appeared first on IoT Business News.