This is a great time to examine the weekly charts of the Economic Modern Family. We like that timeframe for now, with only a short number of trading days left. And there’s lots of news constantly unfolding:

- Rate cuts/no rate cuts

- Middle East heating up with shipping routes in danger

- Soft landing/no soft landing

- Inflation cooling-according to the cooked up numbers

- Consumer sentiment high

So, off to the charts we go.

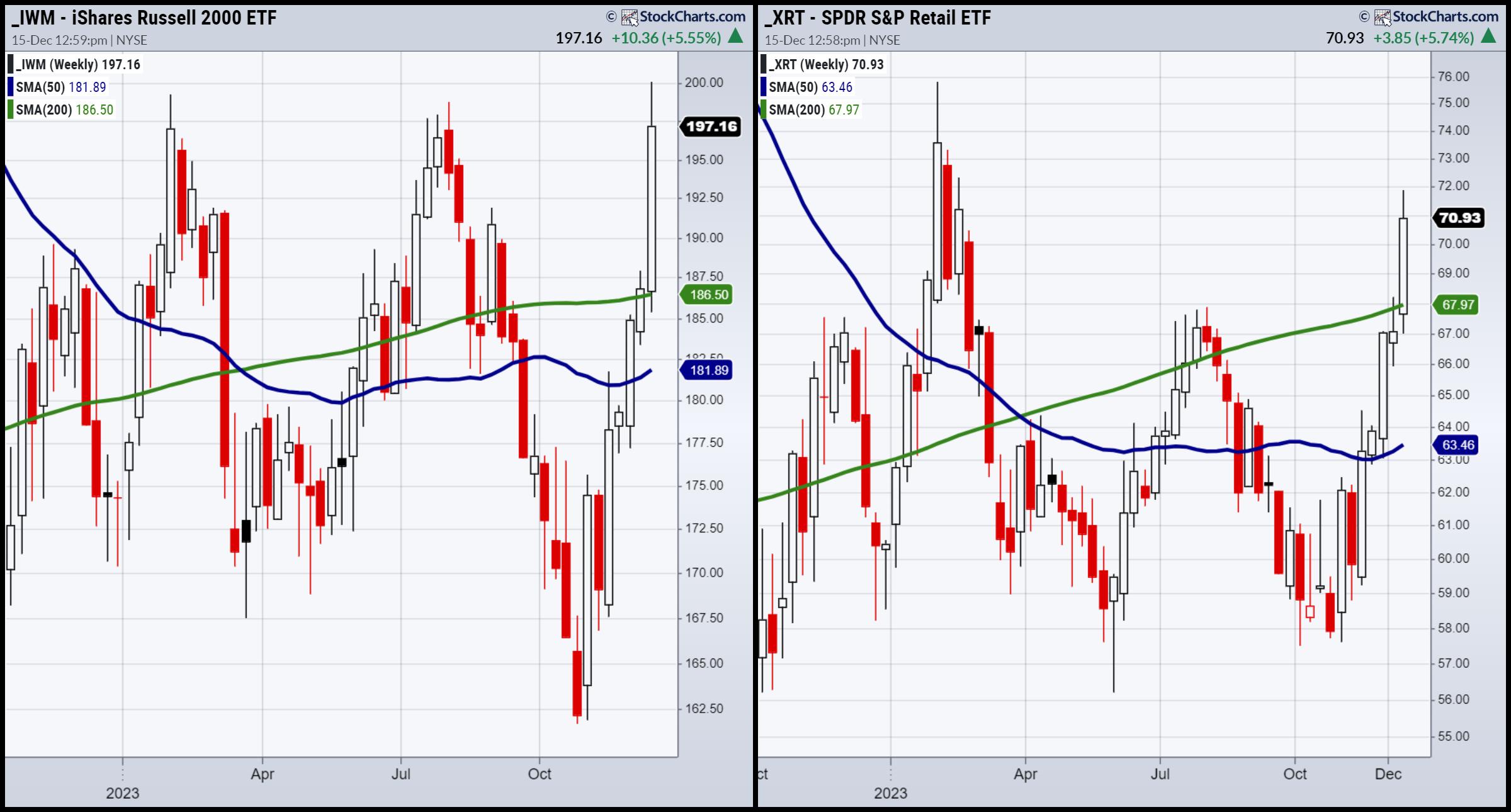

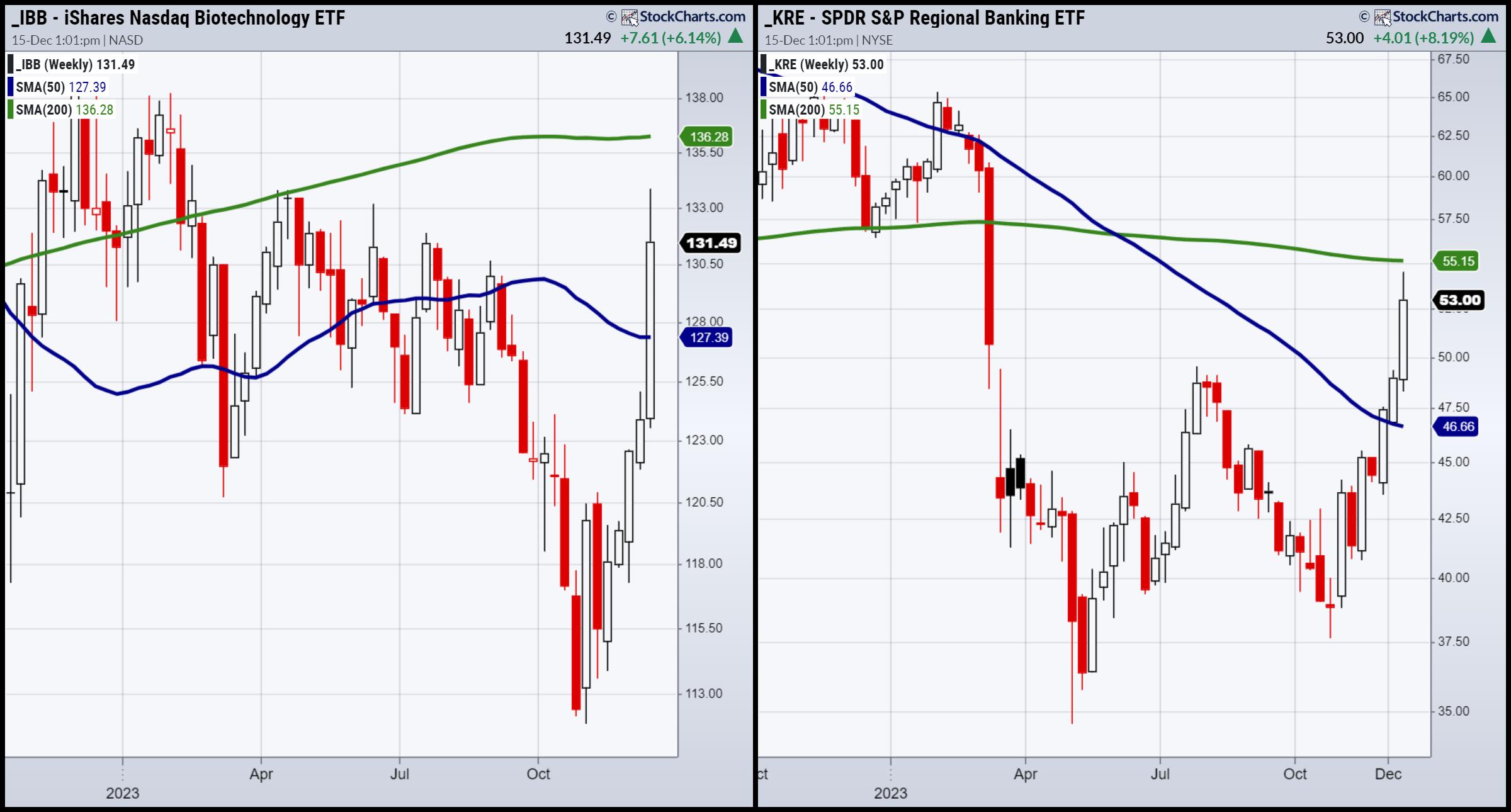

For our Granddad Russell 2000 (IWM), the 2022 high at 227.13 is not even close. However, the 2023 high at 199.26 was taken out this week. Plus, IWM closed under that level, making a double or even triple top a possibility.

How would we know? IWM fails 194. Of course, a move over 200 will be a reason to love Santa even more.

Granny Retail (XRT) has moved well, but, comparatively, it’s still below its 2023 high at 75.77. So, Granny helps, but needs to do more. And under 68.00 could be considered a breakdown.

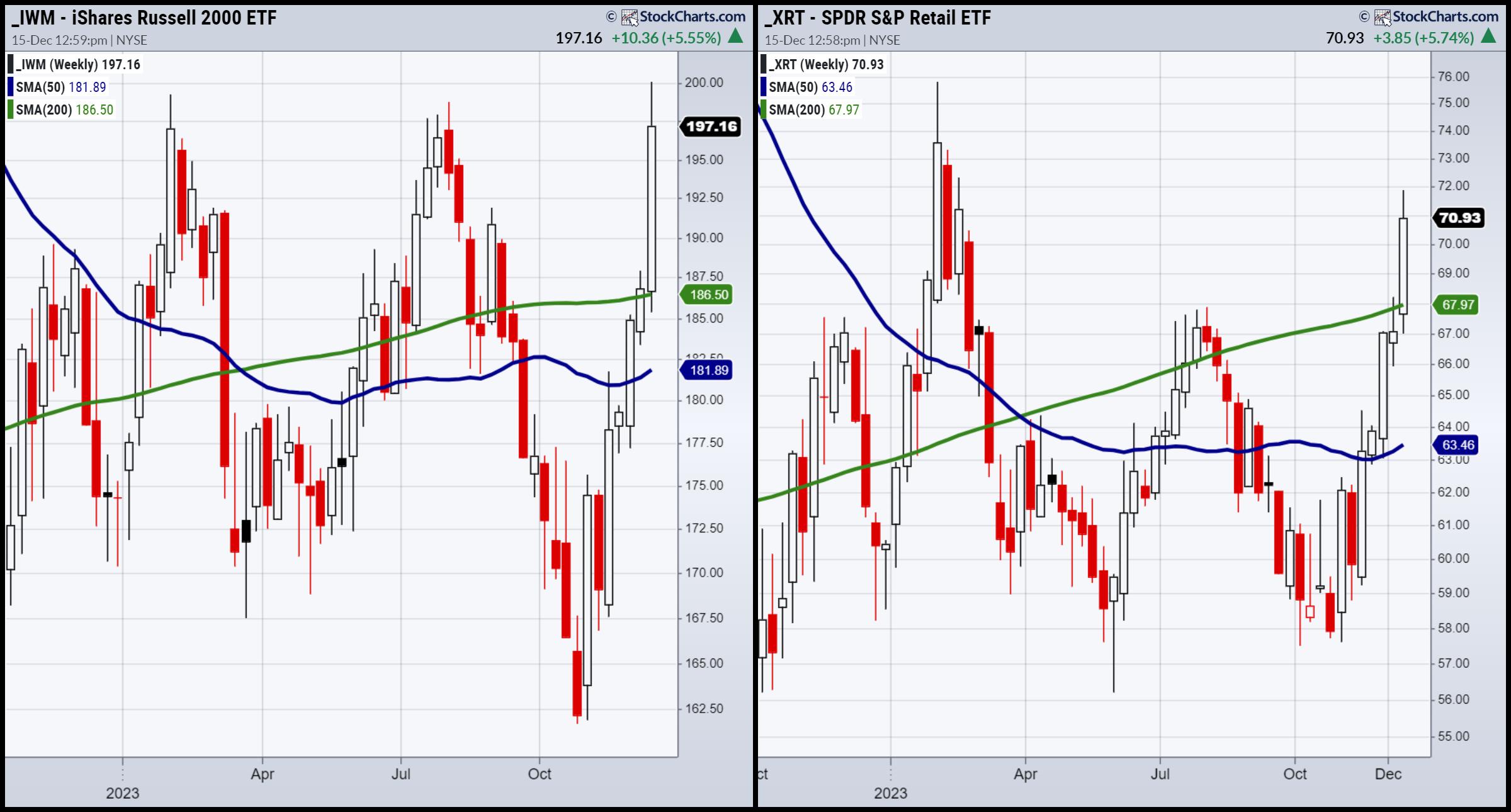

Transportation (IYT) is also at resistance near its 2023 high of 267.85. For reference, its all time high is 282.40 made in 2021. As long as this holds 257, we will remain optimistic.

And that covers the “inside sectors” of the US economy. Strong but frothy and into major resistance. No doubt the US economy outperforms globally.

Emerging Markets

Two weeks ago, we featured the ratio between SPY and Emerging Markets, at 50-year lows. Clearly, EEM has rallied since then. And as we wrote December 1st, “Should EEM clear the 23-month MA that is a start. The risk would be clear, under the low of the month EEM close over the 23-month MA. Then, we would look to see if EEM can clear what appears to be the scene of the breakdown crime, or at 42-43.00.”

That has happened, FYI.

Now, back to our next member of the Family — our Wonder Woman Sister Semiconductors (SMH). SMH made new all-time highs handily. The move over 160 (which was the number we kept writing had to hold) measures to around 240. Can she do it? The only thing that would stop her is if by the end of December, SMH cannot close over 174. That would be a key failure of the monthly chart using Bolinger Bands.

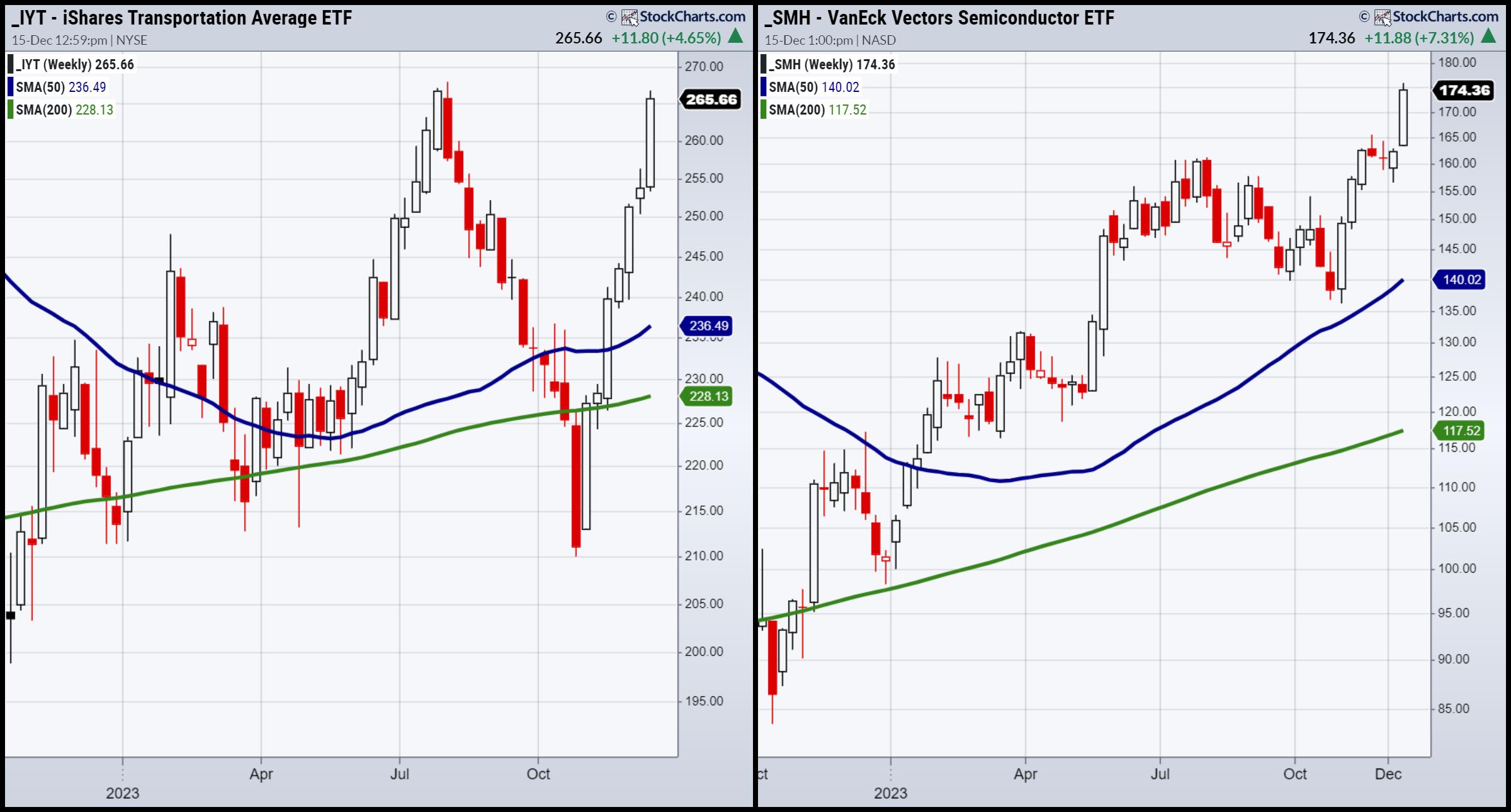

Brother Biotechnology (IBB) proves why weekly charts and stepping back should be part of any trader’s analysis. This week, IBB cleared 120 (as we wrote about as well as a key point), and the 50-week moving average. However, IBB has the 200-WMA looming. And it remains an underperformer. But IBB cleared the 23-month for the first time since 2021. That’s good. So, we watch to see if IBB holds 125 by the end of December.

Lastly, there’s Regional Banks (KRE), our Prodigal Son and everyone’s favorite son. On the monthly chart (not shown), it is right up to resistance at the 23-month MA. On the weekly chart, KRE is at major resistance at the 200-WMA. While this move has wiped out a lot of the losses after the March crash, KRE needs more work to really join the party. Moreover, we are watching KRE to hold 48-49 before we get worried about another down move.

And speaking of Santa, look out for the Outlook 2024 to be released this week!

This is for educational purposes only. Trading comes with risk.

If you find it difficult to execute the MarketGauge strategies or would like to explore how we can do it for you, please email Ben Scheibe at Benny@MGAMLLC.com, our Head of Institutional Sales. Cell: 612-518-2482.

For more detailed trading information about our blended models, tools and trader education courses, contact Rob Quinn, our Chief Strategy Consultant, to learn more.

Traders World Fintech Awards

Get your copy of Plant Your Money Tree: A Guide to Growing Your Wealth.

Grow your wealth today and plant your money tree!

“I grew my money tree and so can you!” – Mish Schneider

“I grew my money tree and so can you!” – Mish Schneider

Follow Mish on Twitter @marketminute for stock picks and more. Follow Mish on Instagram (mishschneider) for daily morning videos. To see updated media clips, click here.

Mish in the Media

Mish makes the case for Vaxcyte (PCVX) and presents the bullish case for gold in this appearance on Business First AM from November 29th.

Mish talksabout money supply, debt, the consumer, inflation and trends that could gain traction in 2024 with Nicole Petallides on Schwab Network.

On the Tuesday, November 28 edition of StockCharts TV’s Your Daily Five, Mish presents 6 stock picks with specific actionable plans.

Mish covers the technical setup for Palo Alto and how MarketGauge’s quant models found this winner on Business First AM.

Mish and Maggie Lake cover inflation, technology, commodities and stock picks in this interview with Real Vision.

Mish talks trading range, fundamentals, and how to think about commodities right now on Yahoo! Finance.

In this appearance on BNN Bloomberg, Mish covers the emotional state of oil and gold, plus talks why small caps are the key right now. She also presents a couple of picks!

Learn how to trade commodities better with Mish in this interview with CNBC Asia!

Mish and Charles Payne discuss why the small caps, now in mid range still have a chance to rally in this appearance on Fox Business’ Making Money with Charles Payne.

Mish talks about Tencent Music Entertainment on Business First AM.

Coming Up:

December 20: Outlook 2024 with StockCharts

December 22: Yahoo! Finance

December 28: Singapore Breakfast Radio

January 2: The Final Bar with David Keller, StockCharts TV

January 5: Daily Briefing, Real Vision

Weekly: Business First AM, CMC Markets

ETF Summary

- S&P 500 (SPY): 475 resistance, 465 underlying support.

- Russell 2000 (IWM): 200 resistance, 194 support.

- Dow (DIA): Strongest index; needs to hold 370.

- Nasdaq (QQQ): 410 resistance with support at 395.

- Regional Banks (KRE): 47 support, 55 resistance.

- Semiconductors (SMH): 174 pivotal support to hold this month.

- Transportation (IYT): Needs to clear these highs and hold 250.

- Biotechnology (IBB): 130 pivotal support.

- Retail (XRT): Huge gap up last 2 days of the week; that now needs to hold.

Mish Schneider

MarketGauge.com

Director of Trading Research and Education