FIRST ON FOX: A bipartisan group of lawmakers from both chambers of Congress has introduced a bill to prevent millionaires from taking unemployment checks.

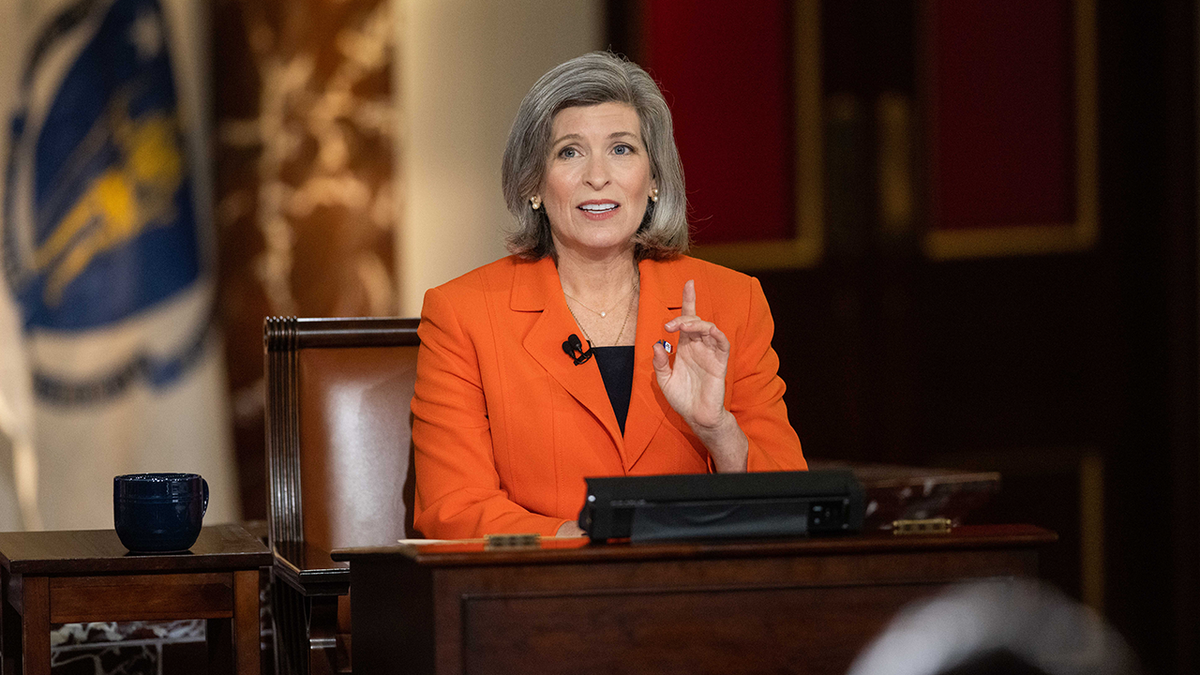

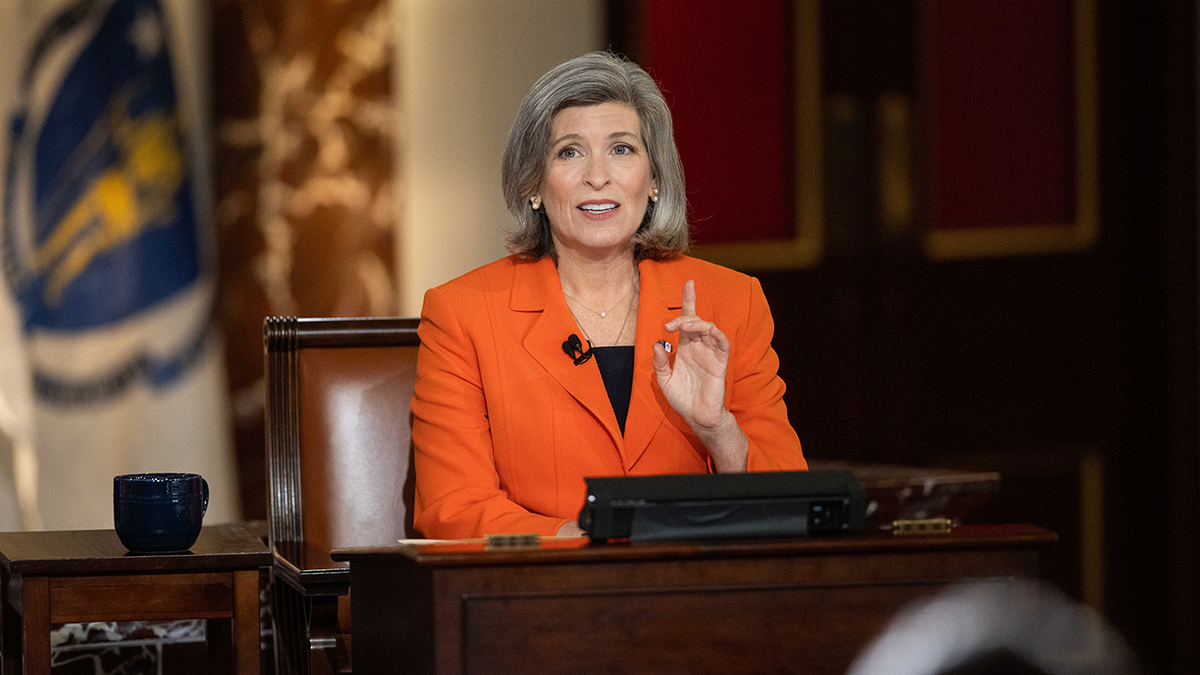

Iowa GOP Sen. Joni Ernst, alongside fellow Sens. Jon Tester, D-Mont., and Mike Braun, R-Ind., on Thursday introduced the Ending Unemployment Payments to Jobless Millionaires Act of 2023.

Utah Republican Rep. John Curtis is the lead sponsor of the House version of the bill.

The bipartisan bill would prevent people who make $1 million or more in income from receiving federal unemployment insurance benefits despite losing their job.

”Bah humbug!’ to this reverse-millionaires tax taking money out of the paychecks of hardworking Americans to pay the wealthy not to work,’ Ernst told Fox News Digital. ‘Ebenezer Scrooge certainly never would have learned the meaning of Christmas if he was visited by Washington bureaucrats instead of three ghosts.’

‘But just like Scrooge, it’s never too late for even the big spenders in Washington to change their ways!’ she continued. ‘We can make that happen by passing this commonsense, bipartisan bill.’

Tester told Fox News Digital that, at ‘a time when Montana families are struggling with rising costs on everything from housing to groceries, it defies logic for multi-millionaires to receive unemployment benefits on the taxpayers’ dime.’

‘I came to Washington to fight for working families, not fat cats who look for loopholes to line their pockets,’ Tester said. ‘My bipartisan bill will cut wasteful spending and put money back in hardworking Montanans pocketbooks where it belongs.’

Curtis told Fox News Digital that, because ‘of a quirk in regulations, unemployment benefits are given based on active income and do not take into account passive sources.’

‘IRS data shows thousands of millionaires are gaming this system to receive unemployment insurance,’ he said.

‘It is embarrassing this bill is even necessary. Millionaires should not be receiving unemployment benefits on taxpayer dime,’ Curtis continued.

Ernst’s office told Fox News Digital that the Internal Revenue Service (IRS) provided information showing that millionaires collected over $200 million in unemployment compensation last year.

Fox News Digital has reached out to the IRS for comment.

Specifically, the bill reads that, notwithstanding ‘any other provision of law,’ federal funds would be barred from being paid out ‘in a year to an individual whose adjusted gross income is equal to or greater than $1,000,000.’

‘Any application for unemployment compensation shall include a form or procedure for an individual applicant to certify that such individual is not prohibited from receiving unemployment compensation pursuant to subsection,’ the bill reads.

‘The certifications required by subsection (b) shall be auditable by the Department of Labor or the Government Accountability Office,’ the bill says.