Fed Interest Rate Decision Sparks Market Rally

In response to the Fed interest rate decision, the Dow soared to record highs, reflecting growing market optimism. The Federal Reserve’s commitment to holding rates steady at 5.25%-5.50% has bolstered investor confidence, leading to significant market upswings. This decision, closely monitored through the Fed Watch Tool, indicates a potential shift in the central bank’s strategy, hinting at a Fed pivot in monetary policy.

Fed’s Strategic Stance on Rates

The Federal Reserve’s latest interest rate decision involved maintaining the current rates, emphasizing a cautious approach in light of evolving economic conditions. The central bank’s strategy, influenced by the Fed dot plot, points to a reliance on forthcoming economic data to guide future decisions. This cautious stance aligns with market expectations and indicates a possible Fed pivot in policy direction.

Treasury Yields React to Fed’s Projections

After the Fed’s interest rate decision, Treasury yields plummeted. This reflects the market’s anticipation of imminent rate cuts. The sentiment of these anticipated cuts is captured by the Fed Watch Tool. Concurrently, the drop in yields, coupled with a weakening dollar, underscores the market’s reaction. This reaction is to the central bank’s policy indications and the possibility of a Fed pivot.

Stock Market Surge Post-Fed Decision

The stock market saw significant gains following the Fed interest rate decision. This was particularly evident in the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite. The rally reflects the market’s positive reception to the Fed’s pivot. Investors are adjusting their strategies in response to the central bank’s guidance.

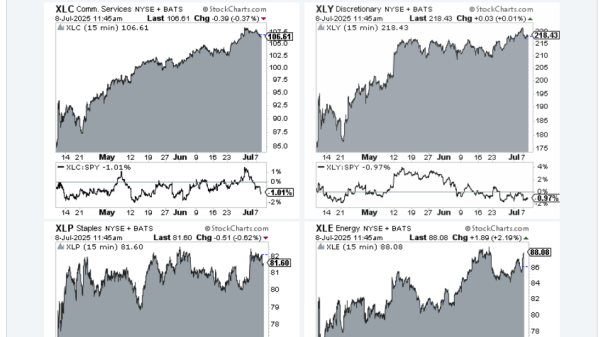

A Bull Market Affirmed by Fed’s Strategy

With the Fed dot plot and projections indicating more rate cuts in 2024, the market has embraced a genuine bull market phase. This shift, closely followed by the Fed Watch Tool, illustrates the impact of the Fed interest rate decision on various market sectors, including those sensitive to interest rates.

Powell’s Remarks and the Fed Pivot

Federal Reserve Chair Jerome Powell’s remarks during the press conference further fueled the positive sentiment in the market. His insights, considered a Fed pivot, have reassured investors, leading to gains across all sectors in the S&P 500, particularly those sensitive to interest rates.

Market Dynamics Amid Fed’s Changing Projections

The Fed’s interest rate decision and subsequent projections have led to a market recalibration. The Fed dot plot and Fed Watch Tool have been instrumental in tracking these changes, indicating a lower peak rate for 2024 and influencing market dynamics.

The post Fed Interest Rate Decision Sparks Market Rally appeared first on FinanceBrokerage.